Estimated reading time: 4 minutes

- Organisations have had to reassess long-standing assumptions and adopt new methods to understand risks as a result of geopolitical uncertainty.

- Marsh’s political risk report identifies three key areas of concern: reshaping global trade dynamics, operational challenges from political risks, and navigating energy transition opportunities amid evolving climate regulations.

Today’s heightened geopolitical risk environment — characterised by volatility, uncertainty, and a widening range of possible outcomes — has become a more significant driven of operational and strategic risks to trade, finance, and investment than in prior periods. Recognising this shift is propelling organisations to evolve their risk management strategies as they prepare for challenges and opportunities that may arise in the latter half of the decade.

To adapt, organisations should reassess the geopolitical assumptions that guide their risk management decisions and investment strategies. Many long-standing assumptions — such as the stability and security of trade flows — are increasingly in flux. In areas where confidence is lacking, organisations may benefit from new methods to understand the risk environment and inform their decisions.

Marsh’s report shows that certain geopolitical assumptions may no longer hold true and suggests frameworks or methods to take their place across three key areas:

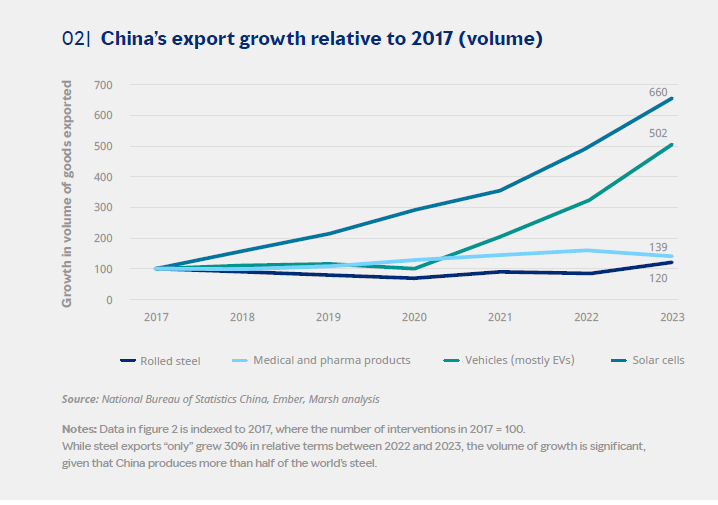

- The reshaping of global trade: Shifting global trade dynamics, including trade tensions between the US and China, will likely continue to test businesses with long investment horizons, complex supply chains, or key supplier dependencies continue to be tested by. This report identifies three factors that can enhance understanding at the business and board level, aiding risk management strategies, and investment decisions.

- Geopolitical risks creating operational challenges: Organisations may encounter operational difficulties exacerbated by their exposure to political risks, including conflict, volatile supply chains, and proliferating trade regulations. The report examines these risks and explores methods to monitor them.

- Energy transition opportunities, politics, and compliance obligations: The report notes two major climate regulations — the European Union’s Carbon Border Adjustment Mechanism and the Deforestation Regulation — and the political forces shaping their development. It also considers methods to reduce risks in expanding carbon credit markets and debt-for-nature swaps.

The risks outlined here are not exhaustive. However, businesses that use this report to improve their ability to comprehend, assess, and where appropriate, mitigate operational and strategic risks will likely be better positioned to identify opportunities where others may only see ambiguity.

Specialist expertise across insurance and risk management solutions, such as that provided by Marsh, can support organisations throughout this journey, helping them thrive in what is likely to remain a challenging geopolitical landscape for some time. The final section of this report—Solutions—provides an initial guide on which solutions may help manage each risk.

One way businesses are managing today’s uncertain geopolitical environment and volatile commodity markets is with optionality, that is, the ability to rapidly pivot to pre-prepared alternative plans in response to changing conditions. However, optionality as a risk management strategy may also impact political risks in certain circumstances.

For example, exploring a range of extractive projects can provide a business with the flexibility to allocate future funding according to shifting market conditions. However, in countries where governments prioritise extraction regardless of the licensee’s interpretation of market dynamics, this strategy could increase the risk of forced contract renegotiations or license cancellations. In the most high-risk countries, risk transfer solutions may be a more viable option to help protect investors.

Source: Marsh Political Risk Report 2025

Preparedness amid a changing climate regulation landscape

Increased climate compliance obligations, especially those originating from new EU regulations, may present operational risk challenges for organisations.

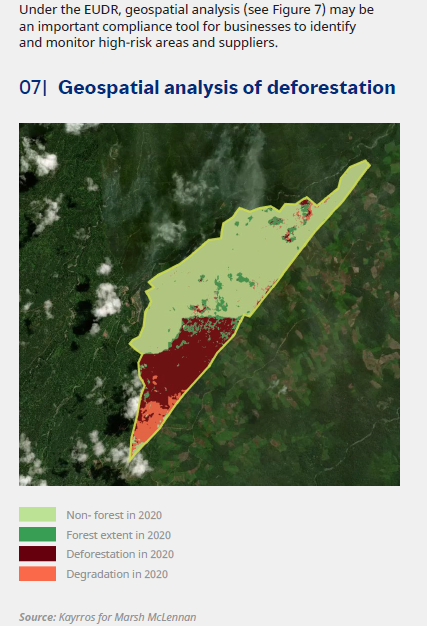

Regulations will increasingly require importers to track emissions and sourcing or face penalties for misreporting. In this context, the EU’s Carbon Border Adjustment Mechanism (CBAM) will target carbon-intensive imports, while the Deforestation Regulation (EUDR) will prohibit the import of goods linked to deforestation. The uncertainty surrounding the implementation timeline and permanence of climate regulations present additional risks beyond the potentially high cost and complexity of maintaining compliance. For example, the EUDR’s full implementation was postponed until the end of 2025 with little warning after an intense lobbying effort. However, many businesses have already invested in reporting technologies or adjusted supply chains to ensure compliance, and last-minute changes may disrupt some operations or cause financial loss. Meanwhile, CBAM, which is set to take effect in 2026, faces similar lobbying pressure to pare back or delay the regulation, particularly from developing countries with carbon-heavy energy mixes that would be most significantly impacted.

To navigate compliance obligations and uncertainties surrounding the implementation and permanence of these regulations, organisations may benefit from adopting robust monitoring capabilities and developing an awareness of evolving political sentiments.

Source: Marsh’s Political Risk Report 2025

Download Marsh’s Political Risk Report 2025 here.