Estimated reading time: 4 minutes

- Most consumers use multiple platforms for cross-border payments, a recent Visa report has found.

- Security is a top priority in cross-border payments.

- Companies should be upfront about transaction costs and processing times to boost customer confidence.

A newly released Visa report into cross-border payments consumer preferences shows a booming industry with a young, varied client base who prioritises security in their payment decisions. Despite a growing range of cross-border payments providers, most users still haven’t found a single trusted platform, instead using multiple different methods and platforms according to their specific needs.

This, the report indicates, is a golden opportunity for payment providers, who can take advantage of a growing, uncommitted market to build a client base and establish themselves as the trusted, go-to platform for all cross-border payments.

An expanding industry

The Visa report surveyed 6,500 people who had made cross-border payments in the previous year and asked them about their habits, preferences, and trusted providers. With an estimated $250 trillion flowing through cross-border payments by 2027, a rise of $100 trillion from the 2017 figures, cross-border payments are a staple of the modern economy, used by a staggering 771 million people every year.

From enabling travel, transferring vital remittance flows, facilitating online commerce, and supporting foreign investment and donations, cross-border payments are set to have an ever-growing role in an increasingly connected world. With over half of the respondents travelling abroad multiple times a year and 45% sending or receiving monthly remittances, there is a wide-ranging demand for safe and reliable payment providers.

The sheer scale of cross-border payments is hard to capture with numbers, with many payments involving small sums which are nonetheless critical lifelines for receivers. About a third of respondents made weekly cross-border payments, and the number rises for young people: 84% of Gen Zers, the youngest group surveyed, made corss-border payments, along with 83% of Millennials.

The search for providers

The prevalence of cross-border payments and growing customer base make the lack of established players all the more surprising. While 66% of consumers surveyed wanted a single, reliable payments provider, only 16% had found a default payment method they could consistently rely on.

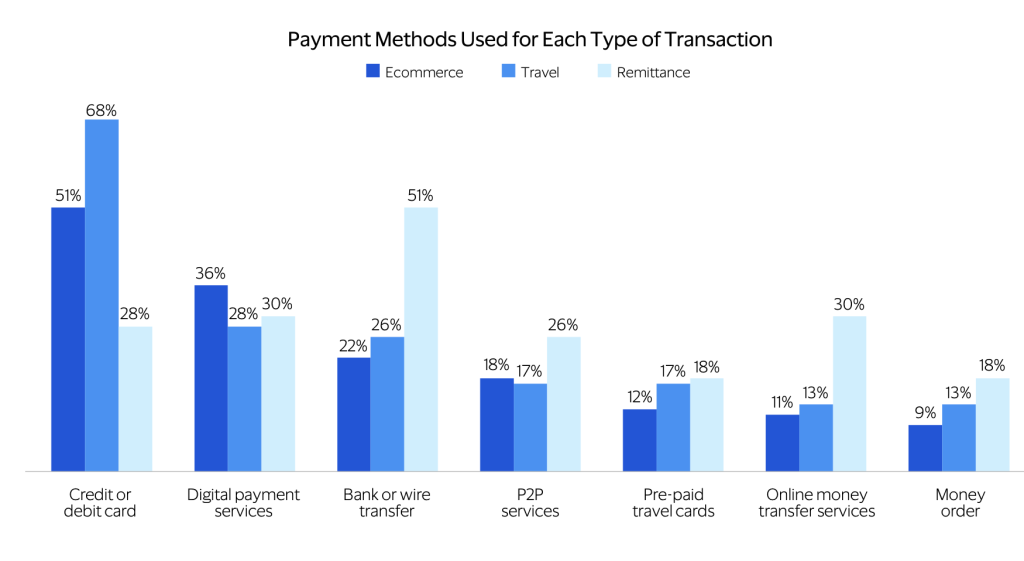

Right now, both payment providers and methods change according to the transaction: credit or debit cards are the preferred method for e-commerce transactions and travel-related payments, while remittances flow mainly through bank transfers.

While 20% of consumers would like to have a wider variety of options for transactions, some reported feeling overwhelmed by the choices, especially those mainly sending and receiving remittances. However, customers seem to be solidifying their habits, moving from multiple providers and methods to one trusted platform: 66% of respondents said that if they found a payment option that worked, they would stick with it. Convenience and trust seem to trump variety, as about half of customers prefer to keep all their money in one account and use one single provider for all their transactions.

Changing priorities

Before convenience, affordability, or reliability, however, customers value security in their cross-border payments above all else. Security was by far the most important factor for customers when choosing a cross-border payment method across all age groups and regions surveyed, ranked by 61% of customers as their number one concern.

This may be due to the prevalence of fraud, scams, delays, and other negative experiences in cross-border payments, reported by a staggering 21% of customers and especially by younger users (‘Gen Z’).

Customers are increasingly conscious of fraud risks, with over half of those surveyed having stopped a transaction out of fear of fraud. This fear is present across a range of payment methods, from credit card transactions to bank transfers, but it tends to be more prevalent when payments are made through newer market entrants that don’t have the same levels of consumer trust as traditional, established players.

Consumers expect payment providers to anticipate these risks: 88% of respondents said they want banks and fintech to establish safety measures and increase security. Simple systems like confirmation of purchase, payments tracking, and recipient verification can go a long way toward making customers feel their money is in good hands and increasing trust.

To reassure customers about delays and hidden fees, which especially worry those sending remittances, companies should be upfront about payment processing times and the costs of a transaction.

—

Ultimately, the Visa report’s lasting message is that the cross-border payments industry is ripe for picking. Transaction volumes are skyrocketing, and a young, varied, and informed customer base knows its options and is shopping around for a go-to provider with security at the forefront.

Cross-border payment providers, from traditional players to new market entrants, have a unique opportunity to establish themselves as the trusted choice and build a solid customer base that will only keep growing. Customer priorities—security, reliability, and variety of options—are clear; payment providers should step up to the plate and build the cross-border payment platforms that customers want.