Estimated reading time: 5 minutes

- Regions in Central and Eastern Europe (CEE) have experienced consistent economic growth in the last 20 years.

- Labour market competitiveness was a crucial component in this success.

- However, inflation has been a persistent problem for CEE countries.

Life is different in CEE than it was two decades ago.

Over this time, the economies in the region have been characterised by impressive growth, continuous convergence with Western Europe, and, more recently, inflation, stagnation, and geopolitical uncertainty.

Understanding this journey requires exploring the critical drivers of economic development, the obstacles that have arisen, and how countries in this region are responding to an ever-changing global environment.

In a speech at FCI’s 15th CEE and SEE Regional Conference on Factoring in Prague, Czech Republic, Mr Vít Mikušek, a macroeconomic analyst at Raiffeisen Bank in the Czech Republic, explored the key themes shaping the CEE economies today, with a particular focus on growth, inflation, competitiveness, and the impact of global volatility.

Economic growth and convergence in CEE

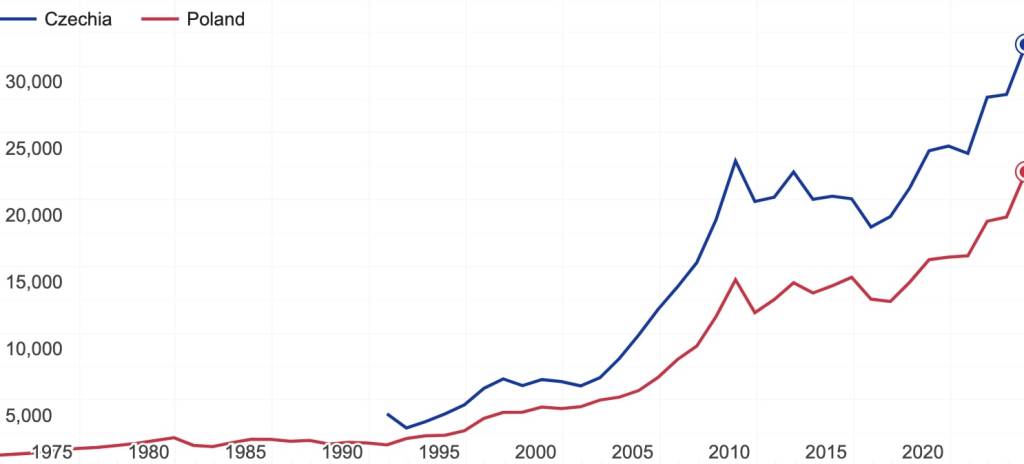

CEE economies have experienced rapid economic growth since the turn of the century. Mikušek said, “In the past roughly 20 years, the Czech Republic has more than doubled our economy. Even more remarkable is the case of Poland, where their economy has almost tripled.”

GDP per capita (current US$) – Poland, Czechia, 2000-2024. Source: World Bank

This growth mirrors the predictions of mainstream economic models, which posit that catching-up economies often grow faster than developed ones, causing them to converge.

However, this particular journey of convergence has not followed a linear path. The COVID-19 pandemic led to stagnation from 2020, with growth trajectories either stalling or slightly declining. By mid-2024, signs of recovery have begun to emerge.

Mikušek said, “We expect that this year we will see a partial recovery, which should accelerate in the coming years, [but it will not be uniform across the region]. When you go from the south and east side of Europe to the west, you will see less and less growth.”

The disparity between countries’ growth rates is partly due to the different stages of economic development. Nations further along the development path face diminishing returns to investment, with growth increasingly relying on innovation and technological progress. To maintain momentum, CEE countries need to enhance productivity and focus on high-value-added industries that drive sustainable economic growth.

Inflation and monetary policy trends

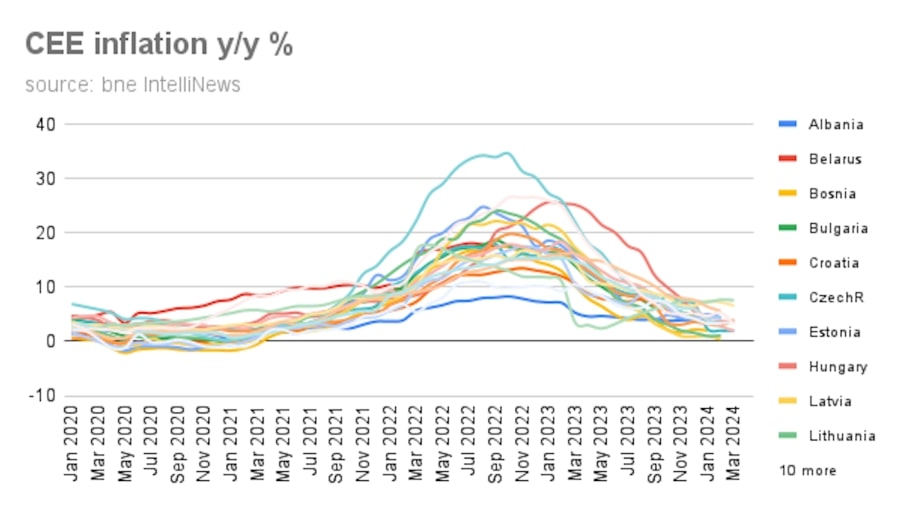

Inflation has been a persistent challenge for the CEE region, particularly since the pandemic.

Inflationary pressures rose sharply, prompting central banks to implement aggressive interest rate hikes. Hungary, for instance, faced the steepest price increases.

Mikušek said, “The interest rate in Hungary was the highest, also following the highest inflation rates in Hungary. But in most countries in CEE, we’re already in the phase of monetary easing, which we expect to continue at least during 2025.”

Prices are beginning to stabilise in some places. The Czech Republic, for example, has seen inflation decline to near its target, prompting a rate-cutting cycle earlier than other countries. However, interest rates are expected to remain above pre-pandemic levels.

Like many factors, this stabilisation has varied considerably by region. While some countries are seeing inflation stabilise, others are still grappling with elevated prices, particularly in services, which directly impacts consumer spending. Balancing inflation control while supporting growth remains central to the monetary policy landscape.

Some countries are benefiting from reduced inflationary pressures, allowing them to stimulate growth through rate cuts. Others are continuing with tight monetary policies to prevent a resurgence of inflation.

Competitiveness and labour market challenges

Competitiveness, particularly in the labour market, is a crucial element of CEE’s economic story. Mikušek highlighted areas of progress seen in the past 20 years: “in terms of increasing standards of living, but we’ve also seen progress in terms of increasing labour costs, sometimes increasing at a faster pace than the value-added.”

These increasing wages, while excellent from a living standard perspective, also lead to increased production costs. Particularly for labour-intensive industries, this can result in a loss of competitiveness: as has been occurring in the CEE, particularly in the Czech Republic.

This is why, in order to maintain high levels of growth, “we would need to see a shift towards higher value-added and continue less with the low value-added production of intermediate goods,” according to Mikušek.

This shift will require significant investments in education, innovation, and technology, but is essential for ensuring sustainable growth, especially as low-cost labour advantages diminish. Tight labour markets, characterised by low unemployment rates and rising wages, support consumer spending but also present challenges due to rising operational costs and skill shortages.

Rising energy costs have further complicated competitiveness. Compared to Western Europe and the United States, energy costs in the region have increased substantially, putting additional pressure on industries.

The region will need to find a way to address these challenges to maintain its competitiveness in the global economy.

Geopolitical factors and exchange rate volatility

Participating in the global economy means dealing with geopolitical factors and fluctuating currency values.

Regional currencies are particularly susceptible to global instability, leading to increased volatility. Tensions in the Middle East escalated in late 2024, leading to spikes in oil prices and currency fluctuations as investors sought safer assets like the US dollar.

Despite these short-term pressures, the long-term outlook for CEE currencies remains positive, buoyed by growth and favourable interest rate differentials.

Central bank policies and geopolitical developments will continue to shape the trajectory of regional exchange rates. As central banks in CEE ease monetary policy, exchange rates will likely adjust, adding complexity to the region’s economic outlook.

The ability to manage exchange rate fluctuations amidst global uncertainty will be key to sustaining economic stability.

It is a fascinating economic time for Central and Eastern Europe.

The region has made impressive progress in closing the gap with Western Europe, but it still faces a number of challenges. Inflation, competitiveness issues, and geopolitical tensions are all weighing on its outlook. However, the region’s overall resilience is encouraging, and the groundwork for long-term growth is being laid through prudent policy decisions and a renewed focus on innovation and high-value industries.

Looking ahead, the key to success will be the ability to foster economic transformation by embracing innovation, enhancing productivity, and ensuring that industries move up the value chain.