- Digitalisation can lubricate the onboarding process.

- Universal standards and regulation are a necessity for simplified digital trade document handling.

- Advanced data analytics can allow financial institutions to better predict risk.

Digitalisation, long viewed as the catalyst for revolutionising trade finance, is one of the most promising avenues to enhance access to financing, particularly for SMEs. The trade finance sector has historically been weighed down by laborious, manual processes—many of which are time-consuming, costly, and prone to error.

Onboarding at scale

For decades, one of the most persistent pain points has been the complexity of Know Your Customer (KYC) processes. These compliance-driven requirements, which mandate thorough client verification, are particularly resource-intensive for smaller transactions and newer businesses.

The financial burden of these procedures, which include extensive documentation and verification, often incentivises financial institutions to focus efforts on their larger clients, who need to finance larger transactions, making it difficult for smaller businesses to secure credit.

Digitalisation, however, promises to automate much of this onboarding process. By digitising KYC checks, banks and financial institutions can reduce the time and resources required to evaluate clients, thereby lowering costs. This shift makes it feasible for financial institutions to serve SMEs at scale without compromising the rigour of due diligence or regulatory compliance.

In summary, as one participant emphasised, “We need to scale. We need to get ready for the potential influx of the origination business coming from the primary centres.”

Standardise to enable document digitalisation at scale

One promising advancement towards achieving this scale has been the Digital Negotiable Instruments (DNI) initiative, which has gained significant traction, outpacing other platforms with similar objectives. The DNI has simplified trade document handling, enabling smoother, faster, and more transparent cross-border transactions.

Electronic documents can be processed faster than paper ones, reducing the time it takes to complete trade transactions. Moreover, digital records offer enhanced traceability and audibility, further strengthening the integrity of trade finance operations.

Another promising development is the rise of the ICC DSI’s KTDDE (Key Trade Documents and Data Elements), which is helping to align data throughout the trade finance ecosystem, reducing the cost and risk associated with constantly transforming data as it moves between systems. The KTDDE also recognises the DNI standards for negotiable instruments as the preferred international format.

In a sector that has long relied on paper-based tools, such as bills of lading and letters of credit, which are slow and susceptible to fraud, loss, or mismanagement, document digitalisation is a critical step forward. However, it cannot be efficiently done without a standardised environment.

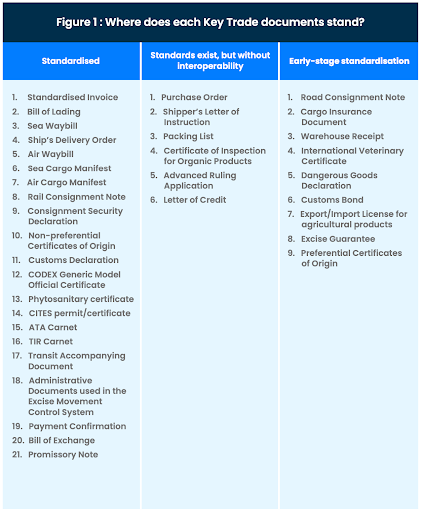

As of the KTDDE November 2023 report, only 21 of the 36 key trade documents analysed are standardised. While more work is needed in these areas, the industry has made significant strides in 2024 and has the potential for further innovation and scaling in 2025.

environment.

Source: ICC DSI, Key Trade Documents and Data Elements, 2024

Beyond standardisation and streamlining the onboarding process, digitalisation allows for better data collection and management, a critical aspect in improving the underwriting and risk assessment processes.

Leveraging data

Through advanced data analytics, financial institutions can draw on a wealth of real-time information to predict risks more accurately and make better-informed decisions. This is particularly vital for SMEs, which often lack the credit histories or financial data that larger corporations can offer.

As one participant noted, “If the transactions are digital with data from the beginning, we are in a different position when it comes to sharing data and harvesting it for downstream processes like sanction screening or risk assessment.”

This real-time data, gathered from digital transactions, enables institutions to assess creditworthiness more effectively, providing a clearer understanding of risk profiles, especially for lesser-known businesses. As more accurate data is fed into the system, financial institutions can build confidence in lending to SMEs, which might have previously been considered too risky.

However, as financial institutions increasingly rely on data-driven algorithms to assess risk, monitoring for potential algorithmic discrimination becomes crucial. Without careful oversight, these systems could unintentionally reinforce biases, disadvantaging certain groups or businesses. Ensuring transparency, fairness, and accountability in the way algorithms process and interpret data will trust and foster inclusive access to trade finance for all SMEs, which are essential steps.

Regulation enabling digitalisation

Regulatory changes, such as the adoption of frameworks like the Model Law on Electronic Transferable Records (MLETR), are also supporting the move towards digitisation.

This regulatory shift is crucial in providing the legal backing for electronic trade documents to be recognised across borders. There is no bigger hurdle to digital document adoption at the firm level than the fear that such a document would not be recognised by the legal system in the event of a dispute.

As more countries adopt MLETR or similar frameworks, the potential for global digital trade finance increases exponentially. One participant said, “We need a more widespread regulatory movement for more geographies to adopt it because trade doesn’t work in isolation. Just the UK passing regulation or one more geography will not be enough.”

Another added, “If we see more adoption, more geographies, and therefore more companies and clients adopting it when our clients push us, we will move.”

SMEs, in particular, stand to benefit from a shift towards a digitally friendly legislative environment. With electronic trade documents reducing the friction in international transactions, SMEs can access new markets and expand their global footprint, backed by faster and more secure trade financing options.

Digitalisation in the years ahead

Digitalisation will help to reshape trade finance by addressing longstanding inefficiencies in processes like KYC, underwriting, and document management, which will narrow the funding gap by making it easier for smaller businesses to access credit.

The use of automated tools, such as AI, for onboarding, policy writing, and risk underwriting will help to consistently lower the costs of servicing clients. These developments, both among the major providers and smaller providers augmented by specialised platform providers, will help make credit insurance cheaper and more open to the smaller end of the SME segment.

But there is more to digitalisation than just digitalisation; without standardised methods and enabling legislation, there can be no digital transformation at scale.

As digital platforms and tools are adopted more widely, they will improve access to financing for SMEs, making it easier, faster, and cheaper for smaller businesses to participate in global trade. By leveraging the power of digital tools, trade finance institutions can open up new opportunities for SMEs to grow and thrive in the international marketplace.

The traction gained in 2024, particularly with initiatives like DNI and KTDDE, indicates a promising future, as the industry looks to build on these advancements and overcome the scaling challenges ahead in 2025.