- Credit insurance, traditionally aimed at large banks, is shifting to meet the needs of SMEs.

- Insurers are starting to innovate their underwriting practices to tailor solutions.

Traditionally viewed as a risk mitigation tool for corporates, SMEs and large banks, credit insurance is now evolving to cater to a broader market.

While SMEs, which are served both by the private market and export credit agencies, have always formed the majority of policyholders in trade credit insurers’ portfolios of clients, historically, credit insurance products were structured for top-tier clients and large corporations, leaving some smaller SMEs underserved. However, in recent years, the demand for more flexible and accessible insurance solutions has grown, prompting a shift in the industry’s approach.

SMEs routinely cede credit insurance policies to their bankers as security to secure adequate financial facilities. Depending on the geography of the policyholder, this has been the market practice since the 1950s-60s.

As regulatory frameworks like Basel IV are implemented and SMEs increasingly seek access to global trade finance, insurers recognise the need to innovate in how they underwrite risks and diversify their portfolios.

The evolving role of credit insurance for SMEs

A participant in the roundtable discussion highlighted this shift, saying, “There is a lot of room for innovation. I want to emphasise that word because what I meant by innovation is not just in tech: this is just innovation in how you underwrite risks.”

This underscores the broader industry recognition that credit insurance must evolve beyond traditional models.

While technology is undoubtedly a key factor in enabling this change, the fundamental approach to risk assessment and underwriting needs to be revised to accommodate SMEs’ unique financing needs.

This includes offering more flexible products, such as tailored premium pricing structures, that align with the varied financial capacities and risk profiles of smaller businesses. Such strategies can help create a more inclusive financial system by ensuring that smaller businesses have access to capital when they need it while still managing their financial risk.

Regulatory drivers: Basel IV and capital relief

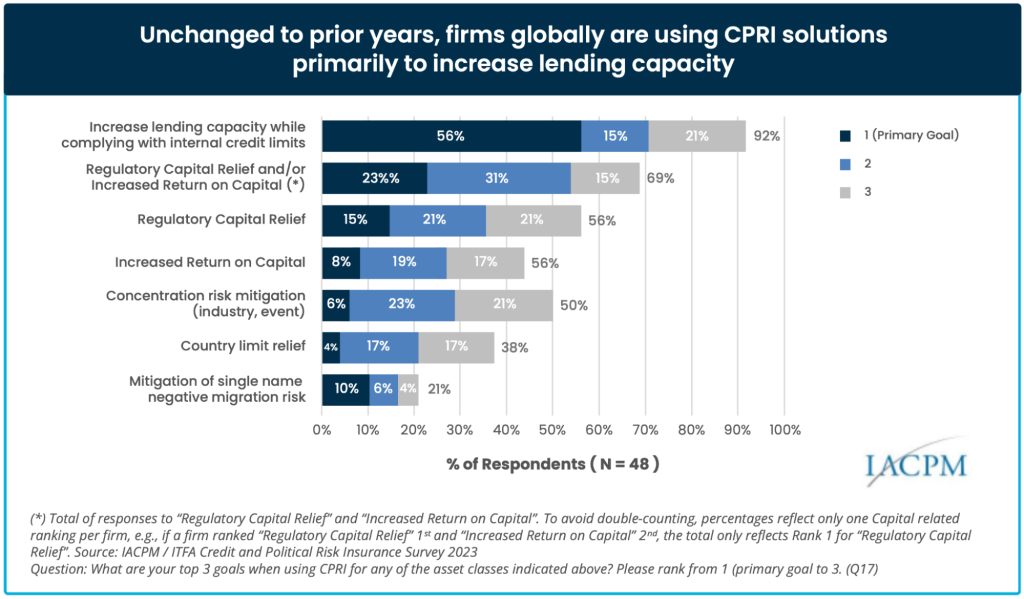

This shift toward innovation in credit insurance comes at a time when regulatory pressures are mounting. Under the Basel IV framework, capital requirements are tightening, especially for banks using the Internal Ratings-Based (IRB) approach, which will be subject to a new “output floor” of 72.5% of the standardised approach.

One participant said, “The regulation is getting tougher, and Basel IV is a key part of that—banks need to manage their capital better, and the insurance market has to evolve to meet those needs.”

This change forces banks to increase their capital buffers, and many anticipate that it will reduce lending by forcing banks to raise capital, shed assets, or reconsider their risk models and lending strategies. This will affect the flow of credit, especially for riskier loans.

The International Credit Insurance and Surety Association (ICISA) and other insurance bodies are critical of the proposed regulations, arguing that the rules fail to acknowledge the role of credit insurance in reducing risk for banks.

Regulators, particularly in the US, have provided a window of opportunity for lobbying efforts to ensure that credit insurance is recognised as an eligible credit risk mitigation tool under the new Basel IV standards.

Credit insurance could provide much-needed regulatory capital relief, allowing banks to offload risk while still complying with the stringent capital requirements set by Basel IV. Insurers, therefore, play a pivotal role in helping banks meet these new regulatory demands by offering products that can efficiently transfer risk.

Diversifying portfolios and increasing competition

The evolving role of credit insurance in trade finance is not limited to banks.

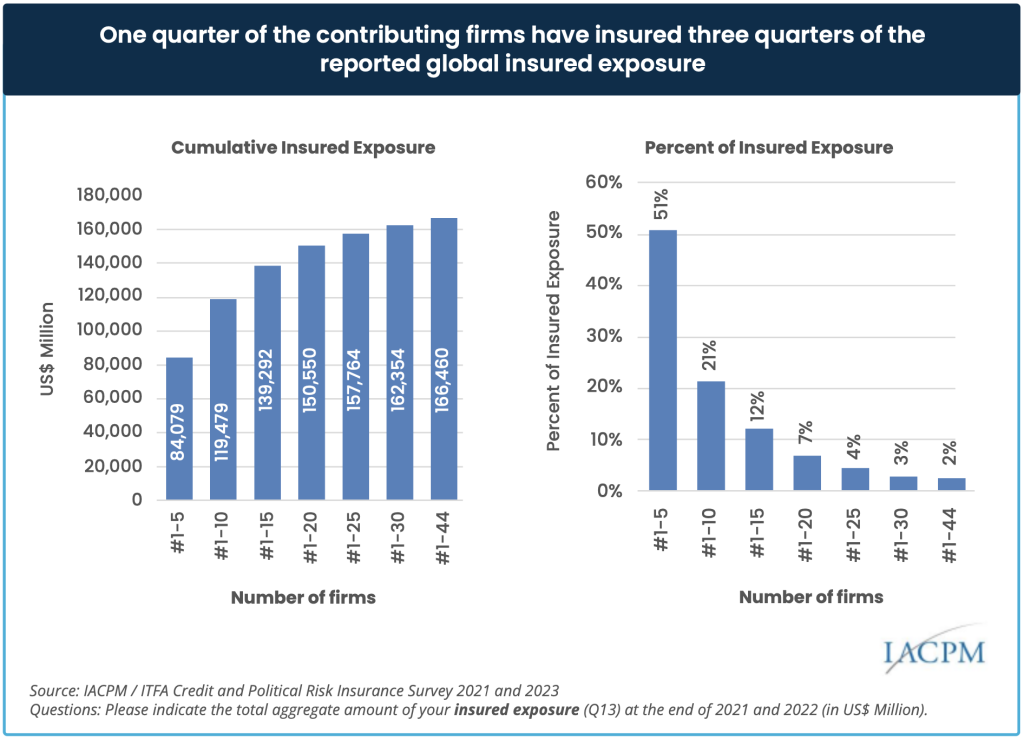

Historically, the credit insurance market was dominated by a small number of large underwriters who primarily focused on large, established institutions, thereby limiting competition and capacity.

However, in the broader credit insurance space, particularly in the context of SMEs and the WTO framework, smaller enterprises have been the majority of policyholders. In contrast, within the single-risk space, demand among smaller firms remains relatively small in terms of the volume of applications and the monetary value involved, making it challenging for underwriters to profitably manage such business.

This dynamic often resulted in capacity constraints for smaller banks and non-bank financial institutions that sought to insure smaller, riskier portfolios. As banks hit exposure limits with these insurers, the need for more diversified and competitive options has become evident.

One participant said, “Insurers are looking to diversify their portfolio of clients. The underwriters are hungry at the moment, and it’s an interesting time.”

This bottleneck creates both a challenge and an opportunity for insurers. By expanding their focus to include a broader range of clients—particularly SMEs—insurers can help distribute risk more effectively and, in doing so, increase liquidity in the market.

The diversification of risk across a wider client base benefits insurers by providing a steadier flow of business and helps banks manage their exposure to individual underwriters.

In this new landscape, competition is essential. One participant said, “Historically, it’s been three underwriters, the large monolines. They cornered the market. The ultimate grail is trying to get more competition into this market.”

Tailoring products to meet SME needs

The challenge remains in balancing the needs of both large and small clients.

Insurers must find ways to tailor their products to the specific needs of SMEs while still maintaining the rigorous risk management practices required by regulators. This requires a mindset shift within the insurance industry, where adaptability and flexibility become paramount.

On distribution, one participant said, “There’s also underwriting of these risks on the origination side. Banks and other NBFIs have been historically using solvency-based models on how to underwrite credit risk. That fundamentally needs to change.”

SMEs often face unique financial constraints—such as fluctuating cash flows, limited access to collateral, and high sensitivity to premium costs—and these challenges are particularly acute in developing markets. Limited data, inconsistent legal environments, and the need for specialised product expertise, which is not always available in these markets, make the role of credit insurers challenging.

The trade credit insurance community is working to overcome these challenges in collaboration with other organisations in the ecosystem, such as DFIs and factoring companies. The solutions that insurers provide must continue to address these realities while innovating to provide profitable offerings tailored specifically to the smaller end of the SME segments as well as those in developing markets.

For example, insurers can continue to help bridge the gap between large corporate clients and smaller businesses, adjusting premium pricing based on an SME’s specific risk profile.

This would increase access to trade finance for SMEs and help spread risk more evenly across the market, enhancing overall liquidity.

Such innovations could also be instrumental in expanding credit insurance’s appeal to a broader range of institutional investors, such as pension funds and private equity, which are becoming more interested in trade finance as an asset class.