- Mentorship in a traditional sense relies on feedback from above.

- But reverse mentorship – where subordinates feed back to their superiors – has great potential in bridging knowledge gaps.

- With challenges persisting for female-owned businesses in trade finance, innovative solutions are being met with more receptiveness.

Gender diversity in trade finance and transaction banking remains a significant challenge. As the industry grapples with this gender gap, innovative approaches will be necessary to foster a more inclusive environment.

One such approach gaining attention is reverse mentorship, a process in which junior employees, often from underrepresented groups, mentor senior leaders.

To learn more about reverse mentoring and other approaches to closing the gender gap in trade finance, Trade Finance Global (TFG) spoke with Rita King, Managing Director and Head of Institutional Trade Sales at Lloyds Bank.

Challenges for female-owned businesses in trade finance

The obstacles faced by female-owned businesses in accessing trade finance are deeply ingrained. One of the most significant is the lack of access to collateral, which, despite often being a prerequisite for securing trade finance, disproportionately affects female entrepreneurs, particularly those leading smaller or newer businesses.

In many regions, especially in emerging markets like Africa, the absence of sufficient collateral leads to the rejection of many trade finance applications from female-led businesses, hampering their ability to grow and perpetuating a cycle of financial exclusion.

King said, “The stats are quite shocking. Only 15% of global exporting firms are female-led. That number is so small.”

Another significant barrier is the knowledge gap. Many women lack awareness of the financial instruments available or do not fully understand how to use these complex tools to their advantage, making it difficult to access the financing they need to expand their businesses.

Addressing these challenges requires more than financial solutions; the industry needs a cultural shift. Financial institutions must recognise women’s unique barriers and work to create more accessible and inclusive financial products.

King said, “If we focus on the collateral piece, there’s a huge opportunity as we look to tech and the digital agenda around using big data and artificial intelligence (AI) to be a catalyst for change. For the knowledge piece, we can play a role as industry leaders to demystify trade.”

By focusing on these areas, the trade finance sector can dismantle the barriers preventing women from fully participating in global trade.

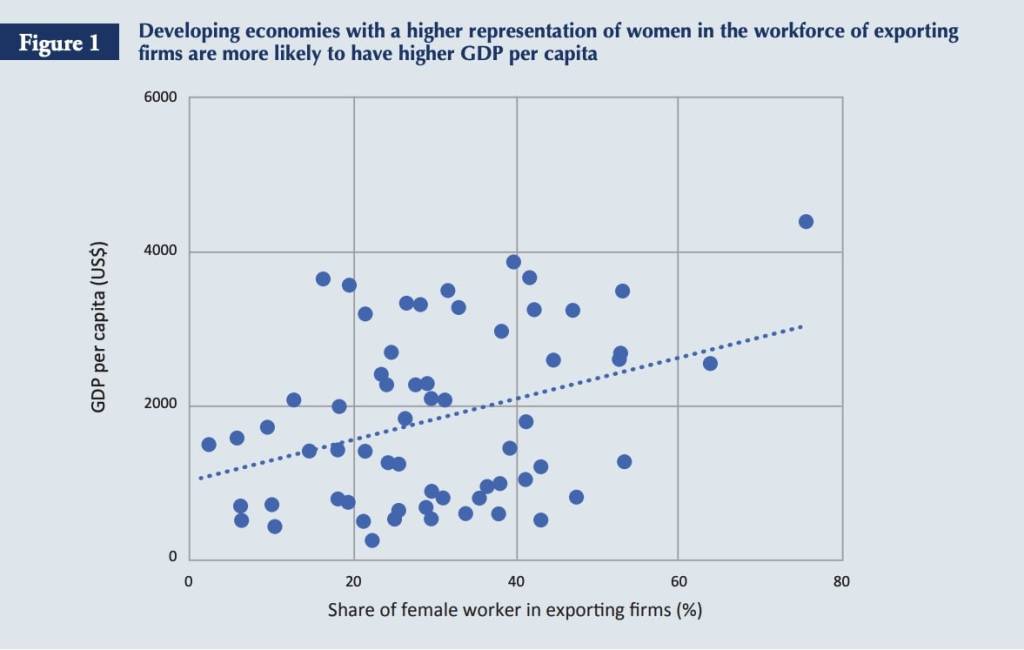

Source: World Bank Group, ‘Women, International Trade, and the Law: Breaking Barriers for Gender Equality in Export-Related Activities’

The role of mentorship in advancing women in banking

Mentorship has long been a powerful tool for career development, particularly for women in the banking sector.

Traditional mentorship, where experienced professionals guide and support junior colleagues, is critical in helping women navigate the complexities of their careers. It provides a platform for knowledge sharing, skill development, and confidence building, all essential for career progression. For many women, having a mentor can be the difference between stagnation and advancement, particularly in a male-dominated industry like banking.

King said, “Mentoring has certainly played a big part in my career so far. I’ve been lucky enough to have some wonderful mentors – both male and female – throughout my career.”

However, traditional mentorship alone may not bridge the gender gap in transaction banking. This is where reverse mentorship can make a significant impact.

Reverse mentorship turns the traditional model on its head, with junior employees mentoring their senior counterparts. This approach allows younger or less experienced employees to share their insights with more seasoned professionals, often bringing fresh perspectives and familiarity with new technologies.

King said, “Reverse mentoring gives a platform for senior leaders to hear the experiences, the challenges, the perceptions, and quite frankly, learn from junior staff members. It’s also important that the junior levels hear that their voice is heard as this helps with engagement and drives a commitment to an inclusive culture.”

In the context of gender diversity, reverse mentorship offers a unique opportunity for junior female employees to educate senior leaders about the challenges women face in the workplace.

Through reverse mentorship, senior leaders can gain a deeper understanding of the barriers that prevent women from advancing in their careers, including issues such as unconscious bias, work-life balance challenges, and the lack of female role models in leadership positions.

By learning directly from those most affected by these issues, leaders are better equipped to implement changes that foster a more inclusive workplace.

This mentoring style can also help break down stereotypes, challenge the traditional power dynamics that often hinder progress towards gender equality, and promote a culture of inclusivity and continuous learning within an organisation.

For female employees, reverse mentorship provides an opportunity to influence the direction of their organisation, making them feel valued and heard. This sense of empowerment can be a powerful motivator, encouraging more women to pursue leadership roles and helping to close the gender gap in trade finance.

Industry-wide initiatives to support gender diversity

While reverse mentorship is valuable for promoting gender diversity within individual organisations, industry-wide initiatives are essential for driving systemic change.

Across the global banking sector, there is growing recognition of the need to address gender disparities, and various initiatives are currently in place to support women in this field, providing them with the resources, networks, and opportunities they need to succeed.

Trade associations and industry bodies increasingly prioritise gender diversity as a critical component of their agendas. These organisations play a crucial role in setting industry standards and best practices, and their commitment to gender diversity can have a significant impact.

These bodies can drive meaningful progress towards gender equality by establishing clear goals and benchmarks, such as increasing the representation of women in leadership roles to overcome the isolation many women experience in male-dominated industries.

Allyship, especially from male colleagues, is also critical for gender equality. Gender diversity is not just a women’s issue; as a business issue, it affects the entire industry. Male allies can play a pivotal role in supporting and advancing gender diversity initiatives, whether through mentoring female colleagues, advocating for inclusive policies, or simply being aware of the challenges women face.

King said, “Everyone needs to be responsible for driving this change because it’s a joint responsibility.”

–

The gender gap in trade finance and transaction banking is a complex issue.

While significant challenges exist, particularly for female-owned businesses seeking access to trade finance, promising solutions are also on the horizon. Reverse mentorship offers a powerful tool for bridging the gender gap by fostering understanding, promoting inclusivity, and empowering women to take on leadership roles.

When combined with industry-wide initiatives and the active involvement of allies, reverse mentorship can help create a more equitable and inclusive banking sector.

As the industry continues to evolve, these efforts will be crucial in ensuring that all professionals, regardless of gender, have the opportunity to succeed in trade finance.