Estimated reading time: 2 minutes

Aon PLC, the global professional services firm, has recently published its 2024 ‘Working Capital Benchmarking Report’ for the Asia Pacific (APAC) region.

The study examined the working capital performance of 947 publicly listed firms across 12 APAC countries and territories and 21 industry groups, over the last five years.

Days receivable, a key component of the cash conversion cycle, measures the average time it takes a company to receive payment after delivering goods or services. A lower figure indicates improved liquidity and working capital management.

Regional overview

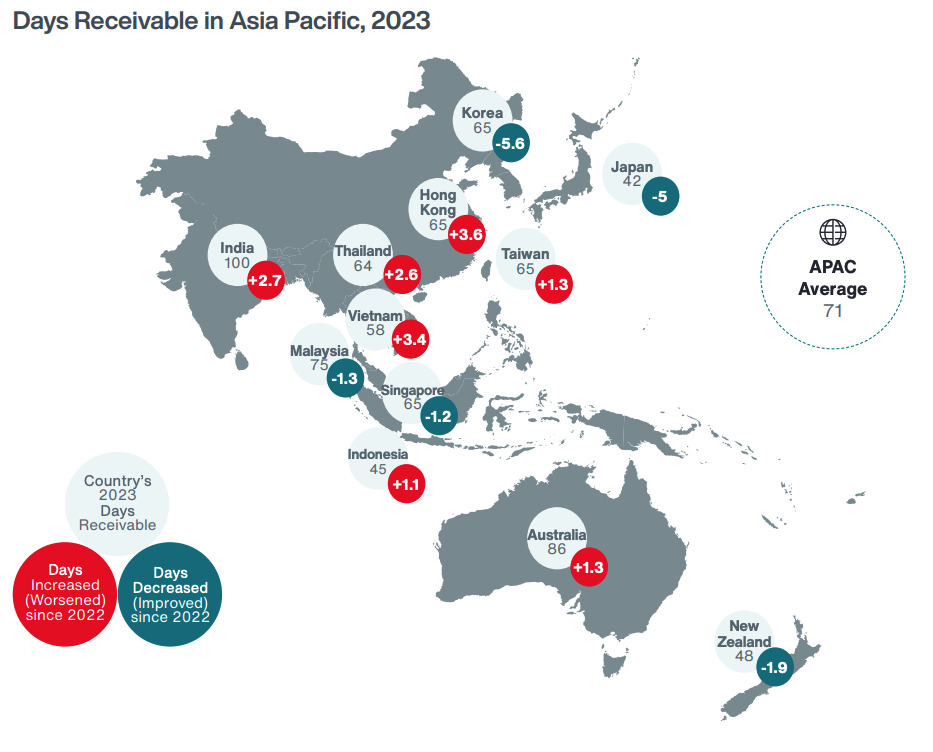

In 2023, the average days receivable for companies across Asia Pacific was 71 days, showing minimal change from 2022. However, significant variations were observed across different countries:

- Japan and South Korea both reduced their days receivable by five days, with Japan overtaking Indonesia as the regional leader at 42 days.

- Hong Kong, Vietnam, and India saw notable increases in days receivable, with India falling further behind at 100 days.

- Despite improvements, Australia remained above the regional average at 86 days.

Industry trends

Over the last three years, almost all 21 industries have been able to reduce their average days receivable. However, the past year gives a different impression: only in retail, automotive, autoparts, telecommunications, IT, and engineering and construction did the average days receivable fall.

The biggest increase in average days receivable – by 9 in the past year – was in the chemicals industry. Regionally, Taiwan led the chemicals industry at 62 days, slightly ahead of South Korea (63 days) and Japan (73 days).

In electrical products, Japan lagged behind the industry average at 99 days, 27 days more than its regional competitor, South Korea.

Australia led the metals industry at 28 days, significantly outperforming the industry average of 59 days.

To improve working capital performance, the report suggests offering early payment discounts to key customers, potentially through dynamic discounting programmes. It also proposes that firms explore credit insurance-backed receivables financing to improve lending terms and broaden eligibility criteria for receivables.

As the cost of capital reaches levels not seen for 15 years, Ankit Tambe, regional director, credit solutions in Asia for Aon, emphasised the need for organisations to benchmark against their peers when assessing financial health and evaluating working capital performance.

He said, “By reviewing credit solutions strategies to shorten the cash conversion cycle and unlock trapped capital, organisations can drive greater value creation and enable business growth.”