Estimated reading time: 3 minutes

The Bank for International Settlement (BIS) announced on Tuesday, September 17, that 41 major private sector financial firms would join Project Agorá, the Basel-based bank’s pioneering wholesale cross-border payments tokenisation project.

Project Agorá was launched in April of this year by the BIS Innovation hub to build and test a technical prototype of a unified ledger for cross-border payments using tokenisation. In ancient Greece, the agora was an open space that served as a meeting space to trade goods and ideas. Project Agorá aims to do just that: integrate tokenised central bank deposits and tokenised central bank money in one core financial platform to simplify and innovate the payment process.

With the tokenisation market estimated to reach $30 trillion in the next 10 years, financial institutions are rushing to take advantage of the unified ledger technology to speed up their operations and improve security. Trade finance assets are predicted to make up as much as 16% of the total value, with companies turning to the technology to digitise outdated manual processes.

Cross-border payments are the perfect candidate for tokenisation: a crucial part of trade finance transactions, they are often strikingly inefficient and affected by long delays. Varying time zones, technical requirements, and financial integrity controls all lead to turnaround times of 5 days or more for a single payment.

Controls are often repeated several times in one transaction to comply with each intermediary’s regulatory requirements, exponentially increasing the time it takes for a payment to go through, and often increasing costs.

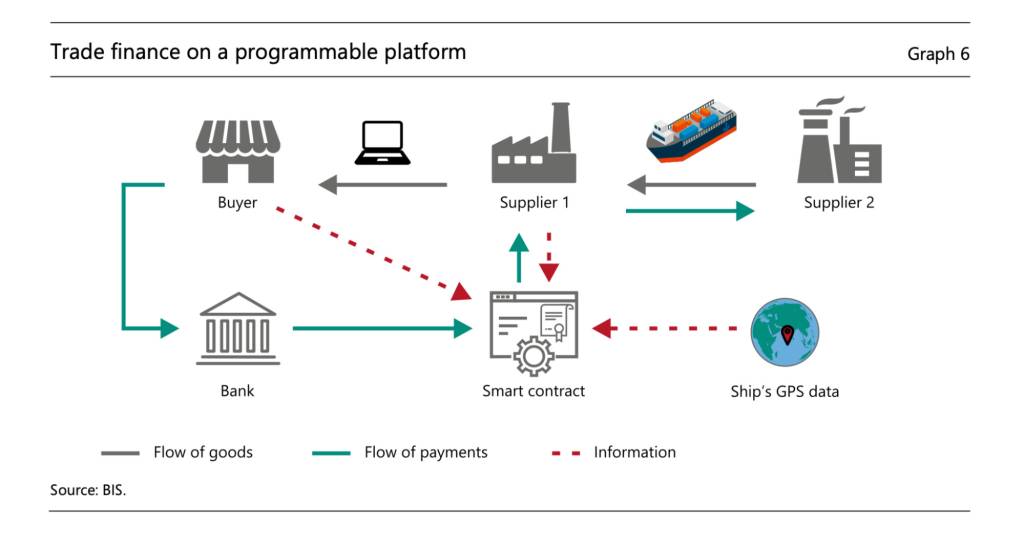

Tokenisation could revolutionise this process by using smart contracts to share information more effectively between intermediaries of a cross-border transaction and open up new ways of managing payments which would have been inefficient using the traditional system.

For example, through tokenisation, information checks that now need to be completed at every step of the payment process could be done only once, and securely accessed by every institution involved. This is expected to significantly increase the speed and reduce the costs of cross-border payments.

Project Agorá, expected to be concluded at the end of 2025, was first proposed by the BIS in its 2023 annual report. The primary purpose of the project is to test whether a multi-currency unified ledger for wholesale cross-border payments is feasible and to determine what legal issues it could face in different jurisdictions.

To this end, BIS has involved seven central banks from a wide range of regions, and the list of private sector collaborators announced on Tuesday spans across service types and countries.

The public-private collaboration is still in its initial stages, having only just entered the design phase. However, its long list of participants shows its immense potential.

Among the companies announced to be joining the project are card payment giants Visa and Mastercard, major banks including HSBC and Deutsche Bank, and financial infrastructure firms Euroclear and Swift.

If successful, the project will “improve existing capabilities and enable new ones, all based on the proven foundations of the two-tier monetary system with central banks at the core,” said BIS Economic Adviser and Head of Research Hyun Song Shin – bringing much-needed innovation to the critical payments infrastructure.