Estimated reading time: 8 minutes

Trade finance is continuously evolving, influenced by economic shifts, technological advancements, and regulatory changes.

The 2024 CGI and BAFT Trade Technology Survey provides insights into how financial institutions navigate these changes and plan for the future. The survey reveals the strategic priorities and challenges which banks face and offers a comprehensive view of their adaptation strategies.

By comparing the 2024 findings with those from 2020 and 2022, the results help to show the industry’s progression and provide insights into the trends shaping its trajectory.

Survey overview

The 2024 edition of the Trade Technology Survey involved participants from across the banking sector, including managing directors (25%), vice presidents (23%), and directors (20%).

The survey examined opinions from a variety of banks globally, with a strong presence of global banks holding assets greater than $1 trillion, capturing the insights of major players in the field.

This diverse range of perspectives from senior leadership provides a holistic view of the industry’s stance on technological and strategic developments.

Unique challenges for 2024

The international trade industry has been particularly volatile in recent years, the result of factors such as the COVID-19 pandemic, increasing weather events, and geopolitical turmoil.

The industry has approached a response to these challenges from different angles. In this regard, technological advancements have introduced both opportunities and novel problems.

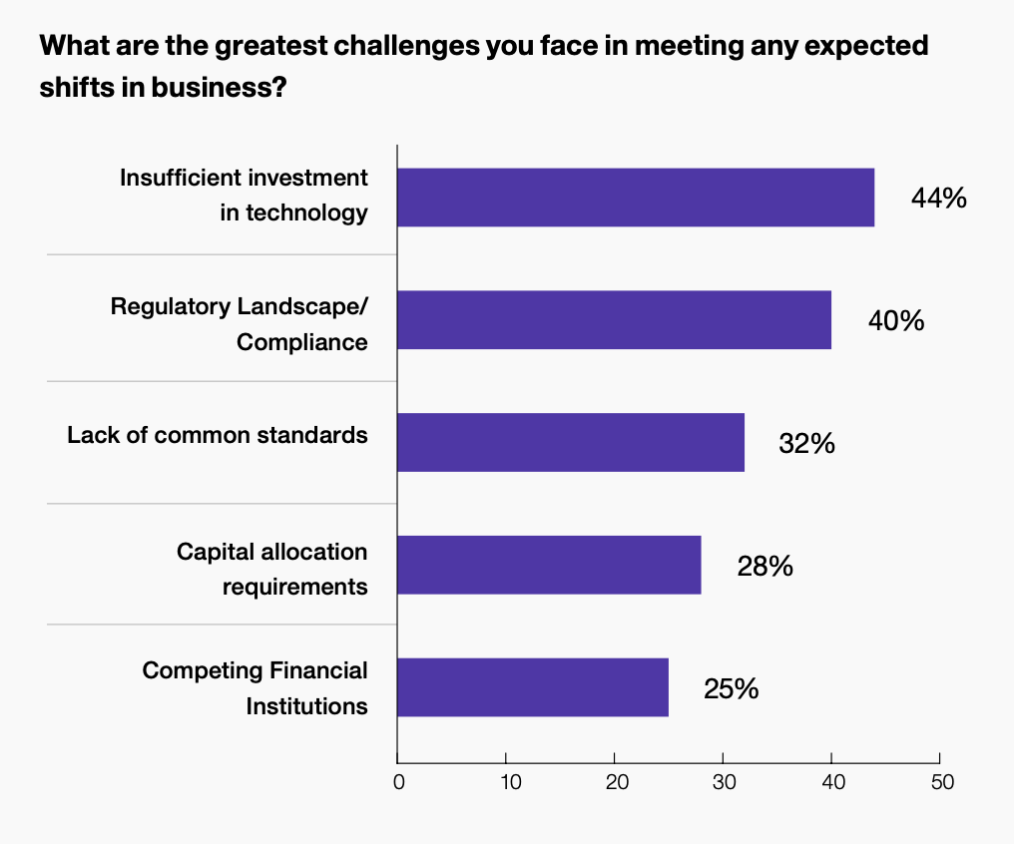

The rapid pace of change has led to multiple platforms closing down, a lack of standardisation and interoperability, and persistent underinvestment in new technologies. On top of this, evolving regulatory landscapes have added layers of complexity, requiring banks to continuously update and refine their compliance strategies.

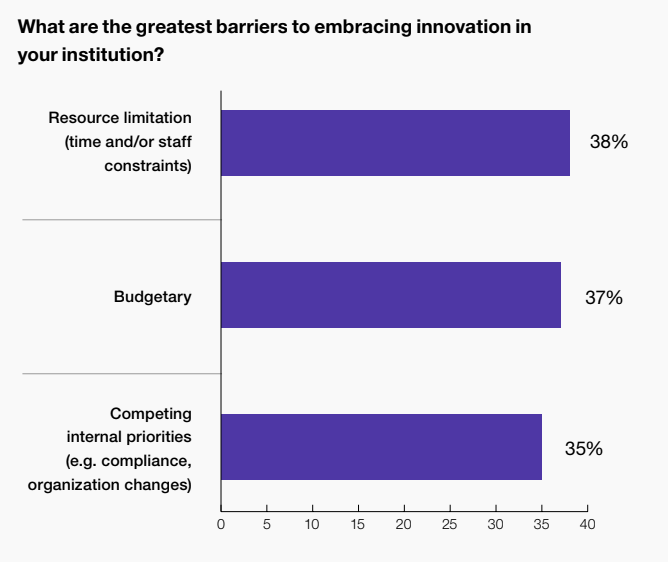

One of the most pressing challenges highlighted in the survey is the difficulty in securing adequate resources and investment dollars.

Financial institutions are under immense pressure to modernise their operations and enhance efficiency, yet budget constraints and competing internal priorities often hinder these efforts. A recurring theme is the need to balance short-term operational demands with long-term strategic goals.

As a result, the survey indicates a mixed sentiment regarding the future, with optimism about technological advancements tempered by concerns over economic stability and regulatory pressures.

Key findings

The key findings from the 2024 CGI and BAFT Trade Technology Survey regard the industry’s technological investments, the dynamic collaborations with fintech firms, and the persistent barriers to innovation.

1. Technological investments

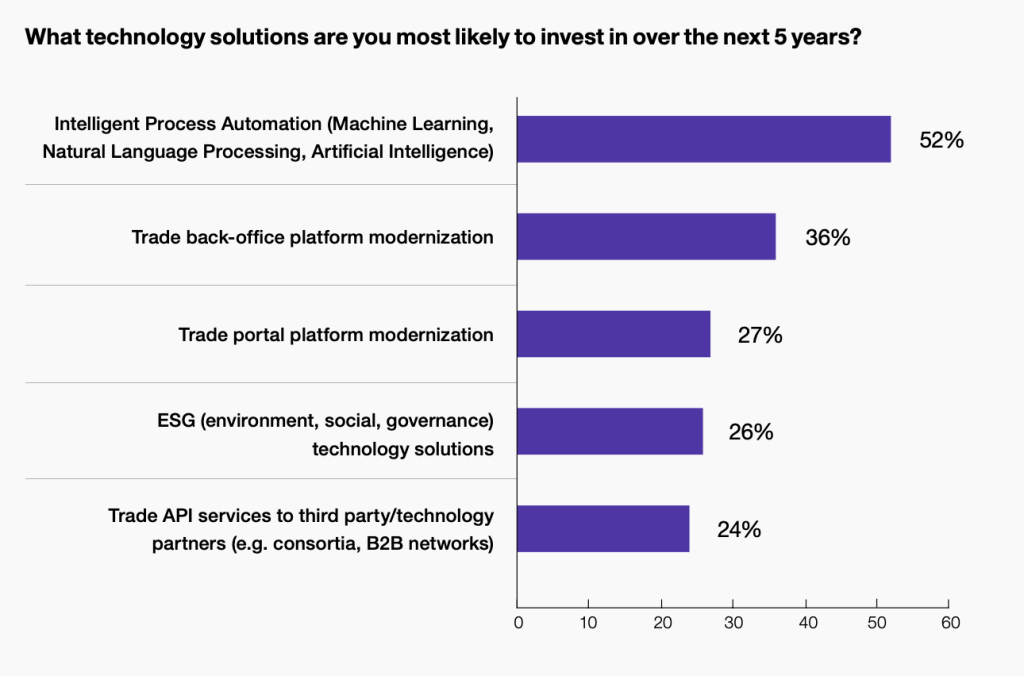

In 2024, banks are increasingly prioritising investments in digitalisation and automation to enhance efficiency and customer service.

Intelligent Process Automation (IPA) technologies – including AI and machine learning – lead the investment priorities, reflecting the growing demand for innovative fintech solutions. For banks processing transactions, these technologies promise significant improvements in operational efficiency, accuracy, and speed.

The survey reveals that banks are not only investing in these advanced technologies but also focusing on seamlessly integrating them into their existing systems. This integration is crucial for realising the full potential of digitalisation, as it ensures that new technologies enhance rather than disrupt current operations.

The emphasis on digitalisation is consistent with broader industry trends towards embracing fintech innovations. Banks recognise that to remain competitive, they must leverage technology to improve their service offerings and meet the evolving needs of their customers.

However, this shift towards digitalisation is not without its challenges. The high costs associated with implementing and maintaining advanced technologies can be prohibitive, especially for smaller institutions with limited budgets. The rapid pace of technological change exacerbates this, requiring banks to continually update their systems and processes, which requires ongoing investment and adaptation.

2. Fintech collaborations

Collaboration with fintech companies remains robust, with over 70% of respondents indicating plans to engage with new fintech partnerships, particularly in areas like blockchain and digital document management. These partnerships are seen as critical for driving innovation and staying ahead of the competition.

By collaborating with fintech firms, banks can access cutting-edge technologies and expertise that may be beyond their internal capabilities. This collaborative approach allows banks to offer their clients more sophisticated and efficient services, enhancing their value proposition.

The survey highlights several key areas where fintech collaborations are making a significant impact.

Blockchain technology, for instance, is being used to improve the security and transparency of transactions, while digital document management systems are streamlining the handling of trade documents. These technologies enhance operational efficiency and reduce the risk of fraud and errors.

Furthermore, the survey indicates that banks are increasingly looking to fintech partnerships to address specific pain points in their operations. For example, many banks leverage fintech solutions to automate manual processes, reducing costs and freeing resources for more strategic initiatives.

Deepesh Patel, Editor-in-Chief at Trade Finance Global, said, “In the news, fintech is often presented as an enemy to banks – a ‘disruptive’ force which challenges traditional banking structures. But the way I see it, bilateral collaborations will enhance output, increasing competition and improving quality across the board.”

A focus on targeted, high-impact collaborations underscores the importance of fintech partnerships in the modern banking landscape.

3. Challenges and barriers

Despite the enthusiasm for technology, the survey highlights significant barriers to adoption.

Top challenges include budgetary constraints and competing internal priorities, such as compliance and organisational changes. These obstacles show the delicate balance institutions must maintain between innovation and operational stability.

Budget constraints are particularly challenging for smaller institutions, which may lack the financial resources to invest in the latest technologies. This can result in a digital divide, where larger banks with more substantial budgets can forge ahead while smaller players struggle to keep up.

The survey also points to regulatory pressures as a major barrier to technological adoption. The need to comply with an ever-growing array of regulations can divert resources away from innovation and towards compliance activities. This is especially true in the current environment, where banks face increased scrutiny from regulators and must ensure that their operations adhere to stringent standards.

Additionally, the survey indicates that internal resistance to change can be a significant hurdle. Many banks have entrenched systems and processes that are difficult to overhaul, and there may be cultural resistance to adopting new technologies.

Tod Burwell, President and CEO at BAFT, said, “The survey findings are consistent with my instincts and anecdotes I’ve heard from banks. There are many automation opportunities, but companies are resource-constrained in how much they can practically execute, and the projects that can deliver clear and immediate returns, such as process automation, are the most logical to start with given budget constraints.

“Overcoming this resistance requires strong leadership, a clear vision for the future, and effective change management strategies to ensure that all stakeholders are on board. “When effectively done,” continued Burwell, “these initiatives also provide a foundation for undertaking bigger, bolder digitisation efforts.”

Comparative analysis with previous surveys

Compared to the 2022 survey results, there is a clear shift towards more strategic technology investments, with a significant increase in commitments towards ESG (Environmental, Social, and Governance) initiatives and compliance technologies. This reflects a broader industry trend towards sustainability and regulatory compliance.

The 2024 survey indicates that banks increasingly recognise the importance of aligning their operations with ESG principles to meet regulatory requirements and enhance their reputations. This shift is driving investments in technologies that support sustainable practices, such as energy-efficient data centres and green financing platforms.

The survey also highlights changes in the types of technologies banks prioritise. In 2022, the focus was primarily on digital transformation initiatives to enhance customer experience and operational efficiency. While these remain important, the 2024 survey shows a renewed emphasis on IPA solutions and broader modernisation projects.

This shift reflects the current economic environment, where banks are pressured to optimise processes and reduce costs. The challenge, as noted in the survey, is to balance these short-term needs with long-term digital transformation goals.

Pamela Mar, Managing Director for ICC DSI, said, “Banks are keen explorers of new technologies and fintech partnerships, to drive operational efficiency, ensure compliance to TBML and AML, and manage risk. The same tools could also be applied to enable finance in underserved emerging markets, particularly among MSMEs.

“Standardised, structured data and new technologies in the hands of banks and financial services providers are the keys to opening this up, and ICC DSI looks forward to continuing to collaborate in this regard.”

Banks must find ways to invest in innovation while also maintaining the flexibility to adapt to changing market conditions and regulatory requirements.

The 2024 CGI and BAFT Trade Technology Survey paints a picture of an industry in transition, actively embracing technological innovation while grappling with significant challenges.

As banks and other financial institutions plot their course through these turbulent waters, the insights provided by the survey can help guide strategic decisions and foster industry collaboration. The ongoing focus on digitalisation, fintech partnerships, and regulatory compliance underscores the need for a balanced approach prioritising both innovation and stability.

By leveraging these insights, financial institutions can navigate the complexities of the modern trade finance landscape and position themselves for long-term success.