Trade Finance is evolving. But one fundamental evolution is not so much in the technology but in the emergence of new players in the Trade Finance space. We spoke to Paul Cohen-Dumani at Micro Informatique & Technologies about the trade finance software market

Where is the trade finance software market headed?

TFG spoke to Paul Cohen-Dumani about his role within MIT and the trade finance software market:

Paul Cohen-Dumani. Bussigny (Lausanne), octobre 2010.

10 years ago, Paul Cohen Dumani became General Manager of the Company. As part of his new assignment, he worked closely with Customers to address the gaps identified in Trade Commodity Finance automation, and in the design of an alternative solution to the Excel spreadsheet widely used in the Trade Commodity Finance industry.

This led to the launch of MIT’s latest software TRAC (Trade Risk Active Control), a Trade Commodity Finance Collateral Management system, now uses by 10 prestigious Banks including NATIXIS, OCBC, SBERBANK, and UBS.

Paul Cohen Dumani holds an MA in Public Relations from Manchester Metropolitan University, and an MBI in IT Management and Organization from the University of Lausanne. During this course, he also wrote a dissertation paper on the Impact of E-commerce in International Trade.

What is MIT and how does it help businesses?

Micro Informatique & Technologies SA, better known as MIT, is an independent Swiss software company founded in 1984, which specializes in delivering information systems to automate and streamline documentary and trade finance operations for banks.

The MIT team is composed of qualified and highly specialized professionals in Banking, Finance, International Trade and Computer Science, and has designed and installed complete Trade Finance systems for prestigious Banks in Switzerland, Europe, Middle East, Asia, and the US.

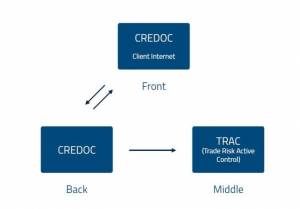

Today, MIT provides a solution for each layer (back, middle, front) of a Trade Finance organization:

-

- Back-end: CREDOC provides full processing of Documentary Credits and Trade Finance operations, guarantees (domestic and international),collections, loans, advances, fund transfers, accounting entries, customized statistics, , and so on…. Built-in access to ” In & Out ” telecom facilities, such as SWIFT, FAX,E-MAIL, MAIL, is included.

- Middle-end: TRAC (Trade Risk Active Control) is a Collateral Management system supporting Structured Trade Commodity Finance.

- Front-end: CREDOC CLIENT INTERNET: white labelled Front-end Trade Finance application connecting Banks with their Customers through the Web

How banks can mitigate trade finance risks using technology and software?

Banks specializing in Trade Finance need to put in balance several indicators in order to monitor efficiently this activity, more precisely the scrupulous respect of financing limits set for each Customer, the level and type of commitments, the evaluation of its collaterals, and first and foremost a good comprehension of the different types of risks involved. A Bank needs generally to look at the following risks:

- Customer Risk or KYC – Know your Customer: A Bank’s Relationship Manager must know his Customer well, and identify whether the skills and professionalism of the latter represent a sufficient guarantee to finance a transaction.

- Country risk: obviously, a risk is evaluated differently depending in which Country the goods are located at a given time. The fact that goods may transit from one Country to another, will have a strong impact on the risk calculation and evaluation.

- Market risk or Price risk: monitoring such risk is fundamental in the perspective. The goods being the only collateral for the Bank, it becomes necessary to follow the price change of commodities. The more volatile the price of a Commodity is, the higher the risk becomes.

- Counterpart risk: the Banks need to evaluate the risk on counterparts of transactions they are financing. Indeed, the second step of a transaction involves a counterpart to which the goods will be sold to, and whose payment will serve to reimburse the amount initially financed.

- Operational risk: The Bank ought to put in place very strict internal procedures for this activity and make sure their employees follow them rigorously. Obviously, the set up of such procedures are accompanied by the implementation of IT solutions designed to apply these procedures in a secure manner, but also to help the Bankers make quick and rational decisions based on valid data updated in real time.

That is why banks need properly designed systems to monitor their risks and collaterals. As of today, when it comes to processing Trade Finance instruments such as for instance Documentary Credits, Guarantees, and documentary collections, Banks are more or less well equipped with back-office processing systems. However, when it comes to monitoring credit facilities, collaterals and risks, most Banks still widely use Excel spreadsheets. And therefore, there is an increasing need to equip middle-office departments with robust systems.

What is TRAC?

TRAC is a Risk and Collateral Management application destined for Trade Commodity Finance or Structured Trade Finance Relationship Managers, Credit Risk Managers, and Top Managers who want to track and monitor their risks appropriately. The purpose of the software is to replace the Excel spreadsheet widely used in the Trade Commodity Finance sector.

More precisely, this application covers

-

- Transactional follow-up of portfolio of active Customers’ global economic position

- Monitoring of customer credit limits or/and groups of customers

- View of accounts’ balance per customer and integration within margin calculation

- Collateral follow-up and management related to the lifecycle of a transaction

- Risk assessment and monitoring of credit facilities

- Multiple purchases and sales per transaction

- Management of vessel information and control based on a bank’s specific standards

- Follow-up of storage facility per transaction with relevant location

- Built-in BI/reporting facility

- Multi-commodity application (Oil, metals, soft, etc…)

- Risk price monitoring “mark-to market”

- Hedge module

- Graphical chronometers per category of risk (eg storage inland, prefinancing, transit, B/L)

- Built-in workflow transaction approval system

- Dashboard view for management

- Warning management facility per customer (credit limits override, collateral due date expiry, documentation follow-up, margin management, etc…)

- Imaging capability (various formats covered such as jpeg, pdf, word, excel, etc..)

- Diary per transaction or customer’s position

What is CREDOC?

CREDOC is a comprehensive Trade Finance and Documentary Business application that covers all the aspects of the area, namely Import & Export documentary credits including stand-by L/C’s, Outward and Inward Guarantees (both international and domestic), Import & Export documentary collections, Reimbursements (confirmed & unconfirmed), Loans & Advances, Discounts…

CREDOC comes with:

- Full Telecommunication environment, such as SWIFT (In and Out), Fax, E-mail as well as remote access from Customers

- A comprehensive and fully automatic Accounting facility, including contingent liabilities, and financial accounting based on a “Report Of Event” clear and open concept Accounting

- Automatic calculation of fees, charges, interests rates for discounts (including “to yield rates”)

- A step-by-step security concept that covers all aspects of the business

- Validation may be applied to any step of the processing

- A huge flexibility that allows any Bank to deal with any documentary and trade finance business

- By rationalizing all processes, from the edition to automatic and transparent accounting and transfers, CREDOC ensures a prompt return on investment

- With tools like CREDOC QUERY and the numerous STATISTICS and REPORTS at hand, risk management is facilitated especially the follow up of Facilities and credit limits by Country, Group of Banks, Banks, Group of customers, or customers

- CREDOC is truly a multi-Bank, multi-Branch and multi-Currency software

What are the biggest issues and challenges within the trade finance technology sector?

The introduction of technology in Trade Finance over the past 30 years has strongly helped Banks and Corporates in managing their volume growths and enhance their efficiencies when processing and exchanging information.

Whether technology can radically change the way Trade Finance is conducted remains to be seen. It will be interesting to see if SWIFT’s BPO will one day pick up. While LC is a Bank’s commitment to pay upon reception of goods related documents, BPO is a commitment to pay based on data matching. BPO has all the ingredients of a game changer in Trade Finance. But again, is BPO bound to succeed and perhaps reduce strongly the use of plain vanilla Trade Finance instruments?

There is also the SWIFT MT 798 message set by SWIFT allowing Corporates and Banks to exchange structured messages using the SWIFT standard format. The demand for this has been increasing in the past years.

Also, we are seeing the introduction of blockchain technology to answer some Trade Finance business cases. Some of them have addressed issues such as de-materialization of physical paperwork, which still remains intensive and cumbersome in Trade Finance. However, those issues have already been addressed in the past 20 years but with different technologies than blockchain.

So fundamentally, can any technology be disruptive and strongly change the way Trade Finance is carried out? It is very difficult to say. There has been indeed a lot of interesting initiatives in the market for the past 30 years. Some have failed and some have succeeded. But those that have succeeded have certainly managed to provide an interesting alternative to the market. Although they have rarely succeeded in imposing a new widely accepted global standard.

What is the future of software in trade finance, and what is next for MIT?

Today the regulatory environment in different countries makes it very difficult for Banks to strongly increase their Trade Finance activity, while there is an exponentially increasing demand for Trade Finance solutions.

So new players have emerged in the Trade Finance space to fill the gap left by Bankers such as:

- Trade Finance funds, that are less impacted by regulatory requirements, and can supply part of a financing to Banks that carry out the business with their Customers, or can finance directly international Traders

- Traders of a certain size are concerned that their suppliers are not getting sufficient access to Trade Finance solutions. So these Traders are putting themselves in place Trade Finance solutions either to finance directly their suppliers, or indirectly by supplying funds to local Banks that can then finance these suppliers.

Those new Trade Finance players will also need the appropriate tools to monitor their risk and collaterals appropriately the way some Banks do already.

MIT is already at the forefront of this fundamental change, as it has the appropriate tools to support these new actors that will need to monitor appropriately the transactions they are financing.