Estimated reading time: 8 minutes

In a room full of trade finance professionals, only one had a client base comprised of at least 50% women.

Only one.

Gender equality remains a pressing issue in international trade, where significant barriers hinder women’s economic opportunities and impact their ability to compete and thrive in global markets.

At the International Finance Corporation’s (IFC) Global Trade Partners Meeting, this room full of female international trade experts discussed the challenges that women entrepreneurs face in the global trade market and strategies for changing the status quo.

The roundtable discussion revealed insights into the obstacles faced by women, as well as innovative strategies that could enhance their participation in trade.

The status quo: Women-led businesses struggle to access trade finance

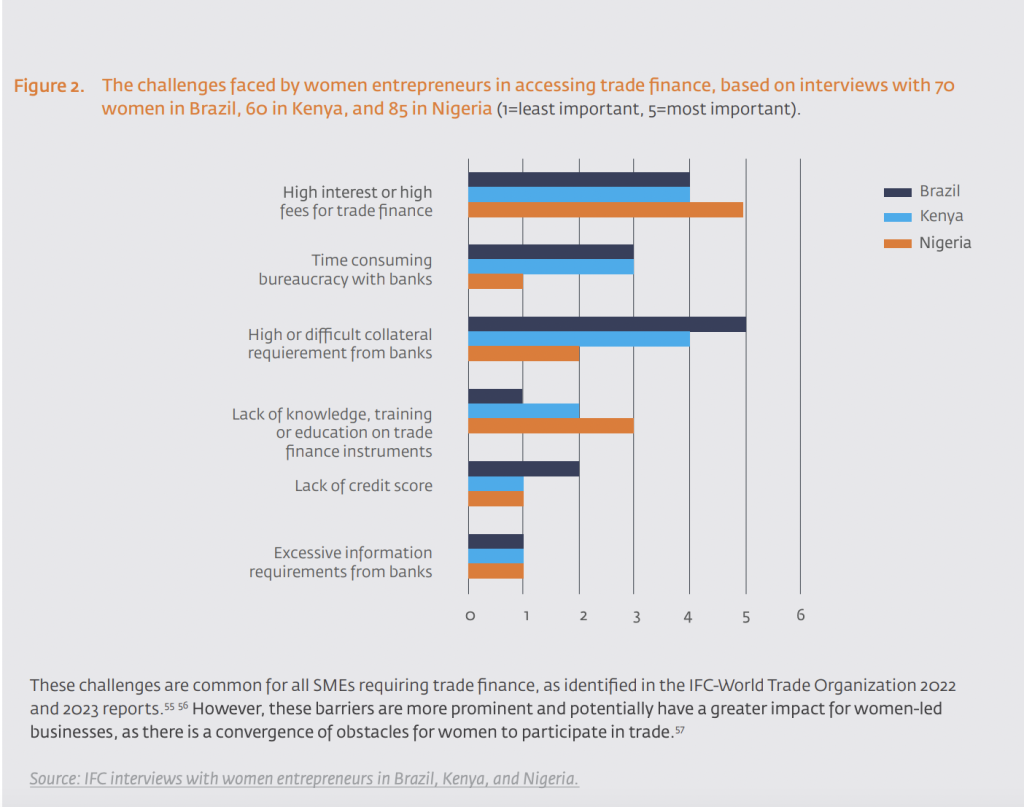

One major obstacle for women-led businesses accessing trade finance is the stringent collateral requirements imposed by financial institutions. Due to the smaller average scale of the businesses they run, women often lack the requisite assets to meet these demands, which disproportionately affects their ability to secure trade finance.

One participant in the roundtable said, “Collateral requirements for trade finance are a major barrier to trade finance for women. In Africa, but also beyond, an overwhelming majority of commercial banks said the absence of collateral is the primary reason for rejecting trade finance applications.”

Moreover, the complexity of documentation processes in trade finance poses another formidable challenge, with a single transaction sometimes requiring up to 100 documents.

Another participant said, “I was shocked to learn that 50 to 60% of the transaction costs come from that 100-document process. That documentation process is really, really burdensome for women and SMEs.”

These barriers manifest differently across regions, reflecting varying cultural, economic, and regulatory environments. In emerging markets, particularly in Africa, legal and societal norms further complicate women’s access to resources and financial services.

For instance, women often encounter significant gender bias, as financial institutions perceive them as higher risk than their male counterparts. This perception persists despite evidence suggesting that women-led firms often have lower non-performing asset ratios. This issue partially stems from a lack of information on both sides of a potential transaction.

One participant said, “There’s an information deficit: Women and SMEs often don’t know how trade finance products work, while banks and financiers are missing data about women, their creditworthiness, and their business history. These information asymmetries create a perception of risk which leads to hesitancy and some reluctance.”

Another added, “We need to start tracking data around women-led businesses in order to see what the trajectories of these companies are. Once we start having data the industry will be better able to focus on overcoming the barriers.”

The impact of these barriers on women’s economic activities is profound. Limited access to trade finance directly constrains women entrepreneurs’ ability to expand their businesses, enter new markets, and increase their economic footprint.

These financial constraints also have broader economic implications, reducing potential job creation and economic growth in their communities.

One participant in the roundtable said, “If women participated in the economy at the same rate as men, economic output could rise by as much as a third.”

The scale of this impact warrants investment into innovative financial solutions to help promote gender inclusion in trade.

Innovative financial solutions for gender-balanced trade

The financial world is constantly evolving, and the latest round involves approaches that are designed to tackle traditional gender barriers, providing more tailored and inclusive financial solutions for women entrepreneurs.

One significant innovation is the development of financial products that do not rely on traditional collateral but instead, use alternative forms of collateral or methods to evaluate creditworthiness.

One participant said, “There needs to be a move away from collateral because these women are often more in a startup position. The big question then becomes: how can you assess risk? We need a whole new way of thinking.”

Some institutions are exploring the use of receivables as collateral, allowing women who may not own property or other traditional assets to still access funding.

Programmes offering blended finance – a new approach that combines concessional and commercial finance – are another promising initiative. They can provide financial resources as well as valuable training and mentorship, addressing both the capital and knowledge gaps that many women face.

These solutions, as part of a broader effort to transform how financiers interact with women-led businesses, signify a shift towards more inclusive financing that addresses the unique challenges faced by women.

Many of these financial innovations, which enhance the visibility of women-led businesses, are being made possible by technological advancements, such as digital platforms and big data.

Technology and digitalisation as catalysts of change

Digital platforms and the integration of big data analytics can transform how women access trade finance by increasing accessibility while reducing costs, which will benefit women, who often run smaller operations and can be more impacted by high transaction costs.

One roundtable participant said, “Technology is helping us to know our customers more intimately and to better understand the credit history of otherwise informal enterprises. Digitisation of trade finance can lower the cost of documentation and make women entrepreneurs visible, which is key.”

Another added, “One great way for technology to help is to enter in credit and risk information that isn’t ordinarily available. So it can substitute or enhance or add to credit information.”

By leveraging data analytics and artificial intelligence, financial institutions can gain previously unavailable insights into the transaction histories and financial behaviours of women entrepreneurs.

These technological advancements represent a shift towards a more inclusive financial system that recognises and caters to the needs of women entrepreneurs, enabling them to compete more effectively globally.

Technology, however, can only go so far. For many women entrepreneurs, building strong networks that can advocate for their unique needs on a larger scale is also needd to have a strong impact.

Equal opportunities through strong networks and advocacy

Many businesses are fuelled by the power of their professional networks.

For women entrepreneurs seeking to enter new markets, having supportive networks and advocacy groups can provide critical platforms for mentorship and education in the global trade environment.

Networks can provide a mechanism for women to collectively address common barriers such as access to finance, legal restrictions, or market entry challenges, enabling them to trade more effectively.

One participant said, “We really think that we need to find a way to reach these women, offer them opportunities because they will drive productivity, they will support economic growth, and they will create jobs and reduce poverty.”

Regular engagement and the sharing of knowledge and best practices will help build a continuous learning environment that supports women’s growth and addresses their immediate challenges.

Advocacy groups can also play a crucial role by highlighting the specific needs of women in trade, advocating for policy changes, and pushing for institutional support at both local and international levels.

Clarifying some of these goals and the steps needed to progress them in the next year was one of the objectives of this roundtable discussion.

Setting the goals for the year ahead

Continuing to promote education and standardisation will be major steps on the road towards promoting gender equality in trade in the year ahead.

For many, however, basic education may have the most significant impact.

One participant said, “We are talking about educating women on trade finance, but it needs to start before trade finance. If you don’t have the basic financial knowledge, you can’t really understand what a letter of credit is.”

On the standardisation side, developing a clear idea of what it means to be a women-led business will allow institutions to collect better data, which will provide critical insights into the challenges women face and the progress being made to overcome them.

Another participant said, “We need to get a clear definition of what a woman-led business is to make sure that everyone looks at this the same way to have a norm across the businesses.”

But for now, the main goal is to test how many of these programs will work in the real world, with real women entrepreneurs, who are running real businesses.

“Maybe the goal is to find 50 women between now and July,” one participant said.

“We don’t need to know everything about them yet. Just find 50 women who own enterprises who might be candidates for your trade programs. Find out where their situation today so we can learn the impact, and figure out how to scale these programs.”

If this happens, by the time of the next IFC Global Trade Partners Meeting next year, we may have a solution to level the gender trading field and increase the number of female decision-makers in international trade.