Estimated reading time: 4 minutes

The trade finance gap is a significant issue globally, and it’s particularly pronounced in developing regions. According to the Asian Development Bank (ADB), the global trade finance gap was estimated at $1.7 trillion in 2021, and it likely increased to at least $2.0 trillion in the following years due to heightened economic and financial uncertainties.

This gap is especially problematic for small and medium-sized enterprises (SMEs), which often struggle to obtain adequate financing, including trade-related financing. The ADB study highlights that 40% of the trade applications rejected by banks are from SMEs.

Supply Chain Finance (SCF), which includes techniques such as factoring and reverse factoring, has emerged as a potential solution to bridge this gap. SCF provides access to working capital finance to SMEs involved in global supply chains. It also helps large buyers enhance their cash position, supporting the overall health and robustness of supply chain ecosystems.

Factoring is a seller-led facility where a seller or supplier of goods or services enters into an agreement with a factor (lender or financier) to purchase the suppliers’ receivables at a discount. On the other hand, reverse factoring (also known as payables finance) is a buyer-led facility where a large buyer enters into an arrangement with a factor to provide finance to the buyers’ suppliers by purchasing the suppliers’ receivables at a discount, on acceptance by the buyer of the sellers’ invoice.

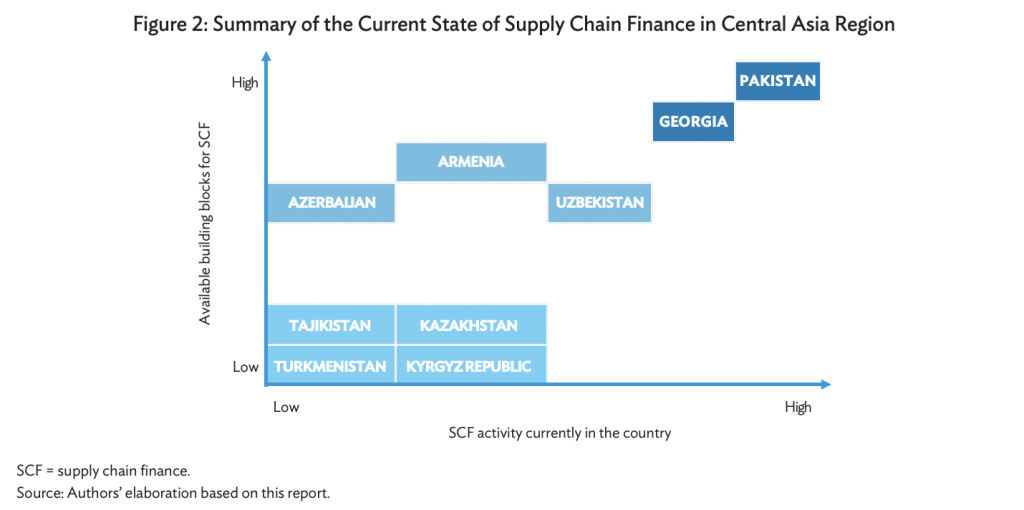

In Central Asia and Caucasus, the potential annual market for SCF is relatively large, up to $18 billion in the medium term. However, few countries in this region use any form of SCF, and in some, the concept is barely known. The countries studied in the ADB brief include Armenia, Azerbaijan, Georgia, Kazakhstan, the Kyrgyz Republic, Pakistan, Tajikistan, Turkmenistan, and Uzbekistan.

SCF in Central Asian and Caucasus

1. Pakistan: The market for SCF in Pakistan is relatively new but has been growing gradually, largely because of strong government initiatives since 2017. The potential medium-term market for SCF is around $9 billion.

2. Uzbekistan: The market for SCF in Uzbekistan is relatively new, with banks only starting to offer SCF products in the past year. The potential medium-term market for SCF is around $1.9 billion.

3. Georgia: Some commercial banks in Georgia currently offer SCF products, and while demand for these services remains low, there has been interest from larger retailers in utilising reverse factoring. The potential medium-term market for SCF is around $0.6 billion.

4. Armenia: The market for factoring services in Armenia is small, largely unregulated, and with a limited range of offerings. The potential medium-term market for SCF is around $0.5 billion.

5. Azerbaijan: The market for factoring services in Azerbaijan is limited, with only a few banks and nonbank financing companies offering these services. The potential medium-term market for SCF is around $1.7 billion.

6. Kazakhstan: The market for factoring services in Kazakhstan is also limited, with only a few banks offering these services. The potential medium-term market for SCF is around $5.4 billion.

7. Kyrgyz Republic, Tajikistan, and Turkmenistan: These countries do not yet offer any form of SCF, and there is no legal framework in place. The potential medium-term markets for SCF are around $0.3 billion, $0.2 billion, and $1.9 billion, respectively.

The unique challenges faced by these Central Asian and Caucasian countries include the absence of enabling regulations, especially for factoring and reverse factoring, lack of awareness and understanding of SCF among SMEs, and the limited capacity of financial institutions to offer SCF products. Moreover, the absence of digital infrastructure and the prevalence of cash transactions also pose significant challenges to the development of SCF in these countries.

While the potential for SCF in Central Asia and the Caucasus is significant, there are numerous challenges that need to be addressed. These include regulatory issues, lack of awareness and understanding of SCF, and the need for capacity building among financial institutions. However, with the right interventions and support, SCF could play a crucial role in bridging the trade finance gap in these regions.

Read the rest of the ADB report here.