Estimated reading time: 5 minutes

Facilitating integration of banks in Emerging Markets into global financial markets

Over the years, the EBRD’s Trade Facilitation Programme (TFP) has helped more than 200 EBRD partner banks in Eastern Europe, the CIS and the Southern and Eastern Mediterranean to establish a track record in trade finance, facilitating their integration into global trade, and more broadly into global financial markets. Promoting such integration remains a key objective of the programme. As new markets develop, a number of new partner banks will continue to be added each year.

A particular impediment to promoting EBRD partner banks’ integration into the global financial markets is the challenge of setting up or retaining correspondent banking relationships with foreign correspondent banks. This is especially relevant for smaller banks, and banks in smaller or higher-risk EBRD countries of operation.

Many banks in EBRD countries of operation find it very difficult to obtain or retain correspondent banking relationships, which also restricts their ability to obtain trade finance facilities from foreign commercial banks. EBRD partner banks that find themselves in such situations typically have no commercial trade credit lines, which often makes EBRD’s TFP (and similar programmes of other IFIs) the only source of trade credit.

There is no immediate or simple solution to this problem. The EBRD and other IFIs showcase the feasibility of collaboration with foreign commercial banks by consistently offering financial and technical assistance to partner banks facing similar challenges. This demonstration paves the way for increased participation of foreign commercial banks in EBRD regions in the future.

The transfer of skills and know-how plays an important role in this journey. The TFP, in close cooperation with international compliance bodies, has developed and rolls-out specific training and advisory programmes to promote international best practices in compliance.

Compliance costs as a barrier to Trade Finance

Many partner banks under the TFP find it increasingly difficult to obtain trade finance facilities from foreign commercial banks, in part due to the increased cost of compliance. Numerous regulatory requirements, from anti-money laundering and counter-terrorism finance regulation, to due diligence (“Know Your Customer” and “Know your Customers’ Customer”) combine to put significant pressure on financial institutions around various forms of risk, including reputational risk.

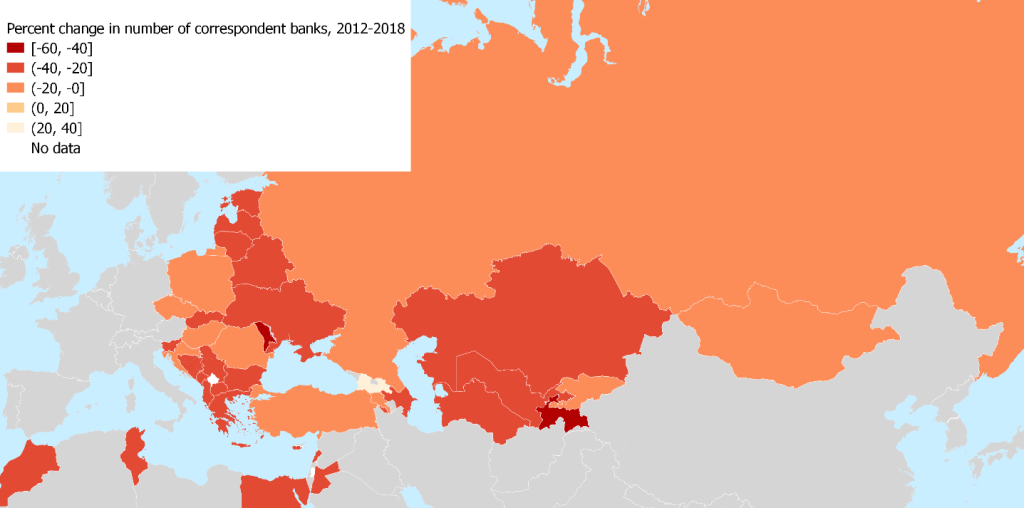

To assess the economic consequences of the reduced availability of correspondent banking, EBRD’s Office of the Chief Economist and its TFP team, conducted a survey among local respondent banks in the EBRD regions. The survey took place at the end of 2019 and covered the period 2009 to 2019. According to the findings of this survey, the countries in the EBRD regions saw, on average, a decline of active correspondent banks by 24% between 2012 and 2018.

Chart 1: Reduction in correspondent banking across the EBRD regions (2012-18)

However, strong variations exist between countries. While the number of correspondent banks decreased by less than 15% in, for instance, Croatia and Turkey (and even increased in economies like Georgia), Latvia faced a 29% decline, Tajikistan a 48% decline, and Moldova a 55% decline. Some of these economies were subject to significant money laundering concerns, which led global correspondent banks to terminate correspondent banking services.

The survey yields three main insights:

- Correspondent bank networks have changed over time. While in 2013, 75% of the correspondent banks originated in the US and Germany, banks from those two countries only hold a combined share of 54% in 2019. Correspondent banks now hail from a wider variety of countries. The replacement of US correspondent banks with those from other regions may be unfavourable to the extent that it leads to longer and costlier intermediation chains.

- Respondent banks report higher costs and more difficulty in accessing correspondent banking services. Local banks find it particularly difficult to access US dollars. While in 2013, only 7% of the banks found it difficult or impossible to access US dollars, this increased to 26% in 2019. Accessing various other cross-border services, such as payment transactions, currency clearing and trade finance, has also proven more difficult. The share of banks reporting difficulties in accessing or having no access to payment services was 5% in 2013 and 13% in 2019. The respective numbers for currency clearing are 20% (11%) in 2013 and 27% (19%) in 2019. About 10% of the banks mention that access to the US has been severely limited or even completely lost due to the withdrawal of correspondent banks.

- Local banks state that the most important reasons for the decline in correspondent banking services are that “correspondent banking relationships do not generate sufficient business to justify the cost of additional customer due diligence” (67%) and that “foreign correspondent banks have terminated relationships as a consequence of the stricter enforcement of anti-money-laundering and combatting-the-financing-of-terrorism regulations” (51%).

How has this drop in access to correspondent banking affected exports across the EBRD regions?

Recent research combines the EBRD survey data on the withdrawal of correspondent banks with bank-level data from Bankfocus; bank branch information from EBRD’s Banking Environment and Performance Survey (BEPS II); and firm-level export data from Orbis. The findings indicate that firms in towns and cities that experienced a substantial withdrawal of correspondent banks have become less likely to export and, conditional on being exporters, export less than firms in towns and cities that did not see a withdrawal of correspondent banks. This suggests that the decline in active correspondent banking across the EBRD regions has had a substantial negative effect on both local banks and their exporting clients.

Trainings and advisory services to improve regulatory compliance

To address the loss of correspondent banking relationships due to the increased challenges of compliance with financial crime legislation, the TFP – in close cooperation with international compliance bodies – has set up trainings and advisory services programmes to promote international practices in compliance:

- Compliance Training: The EBRD launched an e-Learning module “Trade Based Financial Crime Compliance” jointly with the London Institute of Banking and Finance.As of March 2021, a total of 363 students and 93 Partner Banks from 19 economies have taken part.

- Compliance certification. In cooperation with the International Compliance Association (“ICA”), the EBRD financed over 850 scholarships between 2018-2022. Partner banks also benefitted from the ICA professional certificates in, among others, KYC and customer due diligence, trade based money laundering, financial crime prevention, and AML risks in correspondent banking. EBRD and the Association of Certified Anti-Money Laundering Specialists (“ACAMS”) will has established a the ACAMS Eurasian Chapter.

- Individual advisory services. The ICA and EBRD offer services to selected partner banks to identify weak areas and assist in bringing their compliance procedures up to the required international standards.