Estimated reading time: 7 minutes

The global economy has responded to the multiple crises over the past four years differently. Some economies have since recovered and are on track to exceed growth prior to COVID-19, while others still struggle with sticky inflation and low job/wage growth.

Additionally, the outbreak of multiple wars in Europe and the Middle East has continued to strain economic recovery across different regions.

To get a deeper sense of regional recovery and disparities, the European Bank for Reconstruction and Development (EBRD) released its Regional Economic Prospects report for May 2024, offering a detailed analysis of economic developments across its regions.

The report highlights the varied economic performances of different regions, emphasising the impacts of geopolitical events, inflation trends, and policy responses on growth prospects.

Key findings

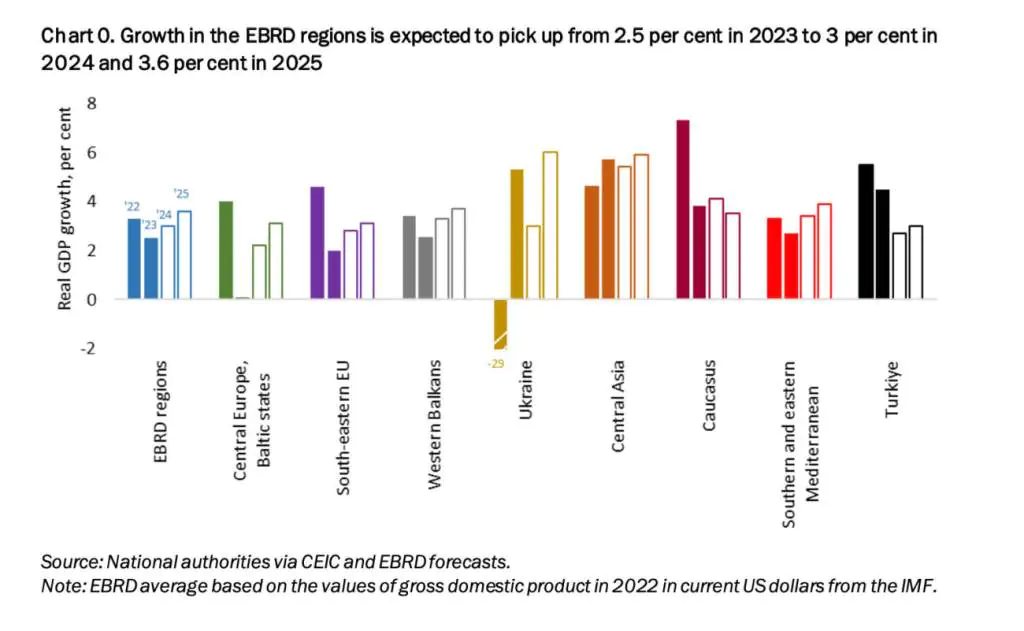

Growth in the EBRD regions slowed from 3.3% in 2022 to 2.5% in 2023, falling below the global average of 2.7%. This deceleration was influenced by the war in Ukraine, persistently high energy prices in Europe, and the diminishing post-COVID recovery in the services sector. However, growth is anticipated to rebound to 3% in 2024, driven by moderating inflation and improving economic conditions in several regions.

Macroeconomic Outlook

Commodity prices

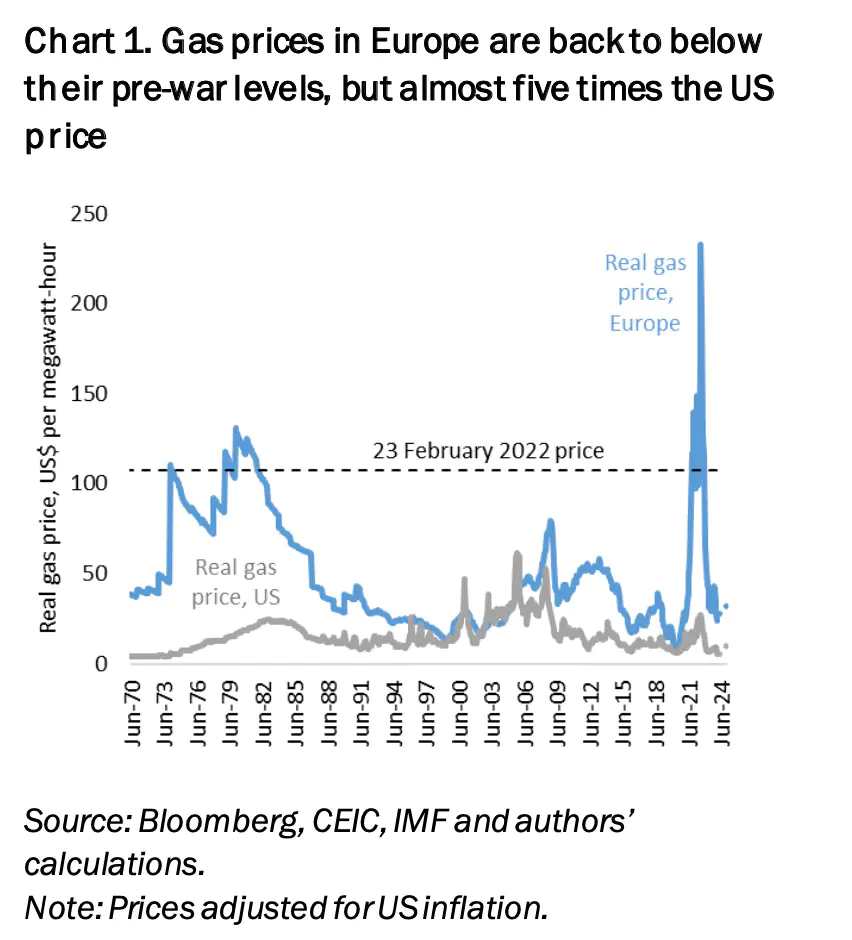

Commodity prices, particularly for energy and food, have been significant drivers of inflation and economic stability in the EBRD regions. The price of gas in Europe saw a sharp increase in late 2022, but as of mid-April 2024, it had eased back to below pre-war levels.

Despite this reduction, European gas prices remain relatively high, trading at almost five times the US price. This high cost of energy continues to pose challenges for European economies, affecting both industrial output and household consumption.

Oil prices have also moderated due to subdued economic activity. The supply of crude oil has generally kept pace with demand since early 2021, which helped mitigate price spikes. The reaction of oil markets to the escalation of conflict in the Middle East was muted by mid-April 2024, with expectations that oil prices would trade around their 2017-2021 average levels, adjusted for US inflation.

Global food markets have seen a normalisation of prices, particularly for wheat. Prices have fallen below their 2017-2021 average, driven by large harvests in the northern hemisphere and increased exports from Russia, which alleviated earlier supply concerns caused by the war in Ukraine.

Monetary policy

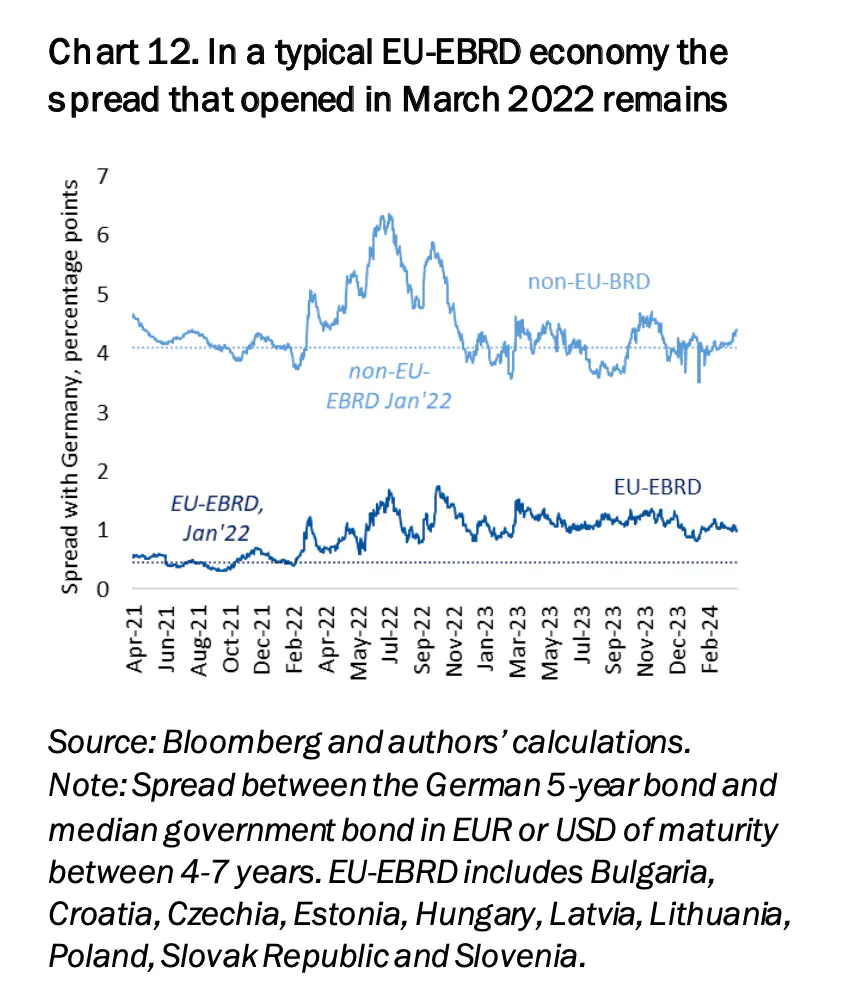

Monetary policy across the EBRD regions has been a critical factor in addressing inflationary pressures. The median yield on 5-year government bonds increased by three percentage points between February 2022 and April 2024.

This rise is largely attributed to monetary tightening in advanced economies, including the US and Germany, where interest rates increased by an average of 2.6 percentage points during this period. The remaining increase is due to a reassessment of economic and geopolitical risks, which widened the spread between EBRD regions and advanced economies.

In the EBRD regions, policy responses have varied significantly. In non-EU EBRD economies, there has been a gradual narrowing of the spread relative to Germany since peaking in August 2022. In contrast, EU-EBRD economies have maintained a wider spread since March 2022, reflecting persistent concerns over economic stability and geopolitical risks.

Inflation control has been a major focus, with policy interest rates remaining higher than they were when inflation peaked in October 2022. Some economies, such as Moldova and Ukraine, have seen notable exceptions where rates have decreased. This divergence in monetary policy reflects the differing economic conditions and inflationary pressures across the regions.

Economic Impact

The tightening of monetary policy has had mixed effects on the EBRD regions. While it has helped to bring down inflation, it has also increased borrowing costs, which can constrain economic growth. Sovereign bond yields remain elevated in several economies, such as Lebanon, Tunisia, and Ukraine, effectively limiting their market access.

The complex interplay between commodity prices and monetary policy underscores the challenges faced by the EBRD regions. High energy prices, despite recent declines, continue to exert pressure on inflation and economic activity.

Meanwhile, the varied responses in monetary policy reflect the diverse economic conditions and risk profiles of the regions. The EBRD’s ongoing analysis and tailored policy recommendations are crucial for navigating these challenges and fostering economic resilience in its regions.

Regional Highlights

Central and South-Eastern Europe

Albania’s economy grew by 3.4% in 2023, with a forecasted growth of 3.3% in 2024. Strong tourism growth and easing inflation are expected to support private consumption, despite risks from potential droughts affecting agriculture and hydropower.

In Bosnia and Herzegovina, growth was modest at 1.7% in 2023, with a forecast of 2.8% in 2024. Political uncertainty and tight labour markets are challenges, though tourism and retail trade show promise.

Eastern Europe and the Caucasus

Georgia’s economic growth slowed to 7.5% in 2023 from double-digit expansions in previous years, driven by construction, trade, and tourism. The outlook for 2024 and 2025 shows moderated growth at 5.2% and 4.6%, respectively, with risks from regional geopolitical instability.

Azerbaijan’s GDP growth in 2023 was 1.1%, hindered by a shrinking oil and gas sector. The non-oil sector grew by 3.7%, and the country is expected to see a slight increase in growth to 3.1% in 2024.

Southern and Eastern Mediterranean

Egypt’s growth is expected to slow to 3% in fiscal year 2024 due to foreign exchange shortages and reform uncertainty. However, the revised IMF programme and significant donor support offer a more favourable outlook for 2025 with a projected growth of 4%.

Morocco’s GDP grew by 3.2% in 2023, driven by a recovering agricultural sector and robust tourism. Despite challenges from an earthquake and high unemployment, growth is forecasted to be 3% in 2024 and 3.6% in 2025.

Central Asia

Kazakhstan saw a 5.1% GDP growth in 2023, driven by strong domestic demand and substantial government expenditure. The growth rate is expected to moderate to 4.5% in 2024.

Western Balkans

Serbia experienced stable growth at 2.5% in 2022 and 2023, with the economy forecast to grow by 3.5% in 2024 and 4% in 2025, supported by declining inflation and preparations for EXPO 2027.

Risks and challenges

The report identifies several risks to the economic outlook, primarily stemming from geopolitical instability and inflationary pressures. Continued conflicts, particularly in Ukraine and the Middle East, pose significant risks to regional stability and economic performance.

High inflation remains a challenge, especially in economies with expansionary fiscal policies. Tightening fiscal and monetary policies in response to inflation could dampen growth prospects. Additionally, weak demand from major export markets, such as the eurozone, continues to be a concern for several economies, particularly those heavily reliant on exports.

The ongoing geopolitical fragmentation is causing a notable rise in defence spending and a shift in trade patterns. As trade tensions escalated, foreign direct investment (FDI) has increasingly targeted “bridging” economies that maintain close trade ties with other blocs.

Inward FDI from China to the EBRD regions picked up sharply in 2023, with significant investments in sectors such as electronics, metals, and renewables. Foreign direct investment from Russia to Central Asia also increased, driven by logistics services.

In Central and South-Eastern Europe, the twenty-year anniversary of EU accession for eight EBRD economies marks a period of fast growth and income convergence. These economies, which include Czechia, Estonia, Hungary, Latvia, Lithuania, Poland, the Slovak Republic, and Slovenia, have seen their GDP per capita rise significantly relative to Germany.

This convergence is partly attributed to the “EU accession bonus,” which facilitated rapid growth in exports as these economies became deeply integrated into European and global supply chains.

The EBRD’s May 2024 Regional Economic Prospects report highlights the diverse economic landscapes across its regions. While there are positive signs of recovery and growth in many areas, significant challenges remain. Policymakers must navigate the delicate balance between fostering economic growth and maintaining fiscal and monetary stability in the face of ongoing geopolitical and economic uncertainties.

The detailed analysis provided by the EBRD offers insights for stakeholders and policymakers as they plan and implement strategies to support sustainable economic growth in their respective regions. The varying performances and prospects of different regions highlight the need for tailored policy responses to address specific economic conditions and challenges.

As global economic conditions evolve, the EBRD’s continuous monitoring and analysis will be crucial in guiding effective policy decisions and fostering resilience in the regions it supports.